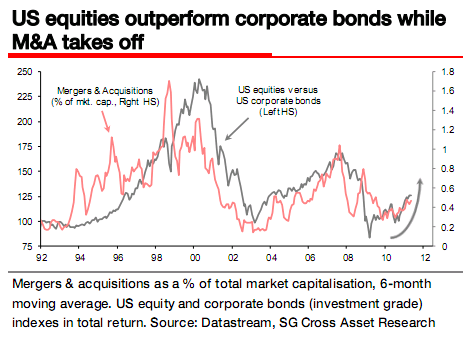

Societe Generale says equities look favorable compared to credit. They see the M&A cycle as playing a key role in potential future outperformance:

M&A cycle very strong start in 2011.

Definitive signs of accelerating.

Europe lagging take-off occurring in the US.Support at the macro level:

– historically low real interest rates

– vanishing fears of double–dip recession

– attractive stock pricesSupport at the micro level:

– corporate deleveraging

– strong cash positions

– productivity gains in the wake of the global financial crisisEquities tend to outperform credit when the M&A cycle gets stronger.

Switch progressively asset allocation in favour of equities.

– Early stages of M&A cycles: rather neutral for credit as they take place under conservative funding structures. The use of cash for completing acquisitions is currently at record levels.

– Later stages: credit quality usually deteriorates as result of more aggressive funding structures. If cycle gathers momentum as we expect, our preference for equities will be more pronounced.

Source: Societe Generale

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.