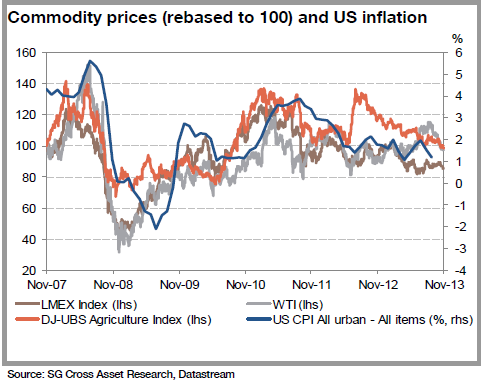

As the inflation from QE never arrives it actually looks like deflation might be creeping up on some of the world’s economies. And SocGen analysts think that means there could be more downside in commodities which tend to trend with inflation:

“Commodities can be seen as a leading indicator of the threat of deflation. As Fed policy is likely to change, with tapering now expected in 2014, commodity prices may correct further with the rise of US rates. And, this decline in commodity prices also reflects fears of a strong deceleration in emerging markets. Overall, “most of the emerging economies have underlying fragilities” according to the OECD. In China, although Wei Yao, our economist, finds the reform proposal encouraging, she remains concerned that reform could accelerate the unwinding of China’s debt problem. China’s growth in this context should continue to decelerate to an estimate 6.9% in 2014. Hence, commodity prices face further downside risks next year. And, already, LME and agricultural index are close to three-year lows.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.