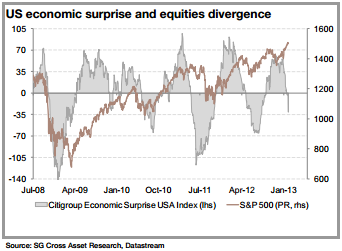

Divergences, complacency, Fed easing, moderate economic expansion, single digit earnings growth, etc, etc. I don’t know what it all adds up to, but SocGen says the recent spate of weak economic data combined with the divergence in stock prices means downside risks are elevated:

“As noted above, recent inflows from bonds into equity have been underpinned by the fading of several systemic risks and steady support from central bank. These inflows also reflected the relative appeal of dividend yields (2.5% for the S&P 500) compared to bond yields (2%). But the US equity rally has been impressive (+5.4% for the S&P 500 in Jan. 13 alone), given the slow pace of the economic recovery.

Indeed, Q4 GDP contracted by an annualised 0.1% (qoq), while sales forecasts remain weak and earnings growth has slowed down since summer 2011. With the lack of positive economic data, the S&P500 looks overvalued (see our NFP model) and therefore the “risk on mode” could come to an end in the near term.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.