The bears just can’t catch a break in this market as the macro data just keeps coming in relatively strong. Today’s employment report was no exception as headline payrolls came in at 321K which was much stronger than analyst expectations of 230K. The unemployment rate was steady at 5.8%, but the U6 rate fell to 11.4% from 11.5%.

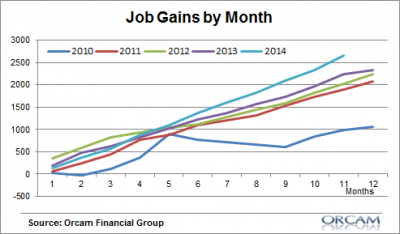

When we look at 2014 relative to other years of the recovery we’re seeing the strongest gains in jobs during the recovery. And not by a small margin:

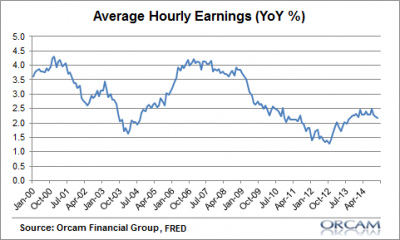

But let’s get to the point. Okay, so the economy is stronger, but are we entering a period of “normalization”? In my opinion, we’re still muddling through. Yes, the job gains were impressive, but the U6 rate is actually higher than at any point since it was first tracked in 1994. And the average hourly earnings still point to a labor market with significant slack. Yes, wages are still experiencing disinflation despite the pick-up in jobs.

This is an employment report that shows the US economy is still moving in the right direction. But it is not a report that warrants concern of rising wage pressures and inflation. The Federal Reserve would be making a mistake to assume that this report is a precursor to high inflation warranting tightening in policy. If I were on the FOMC I would have 4 simple words stolen from Jive Lady and the movie Airplane: “jus, hang loose blood.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.