In a recent Bloomberg interview Jeff Gundlach said the corporate bond market looks as though “something” is broken. Via Bloomberg:

“Something funny is going on in the world of corporate bonds now — something looks broken,” he said. “It seems there’s less willingness all of a sudden to be lending money to corporations, maybe because the absolute yields are so low. You’re starting to see that saturation point.”

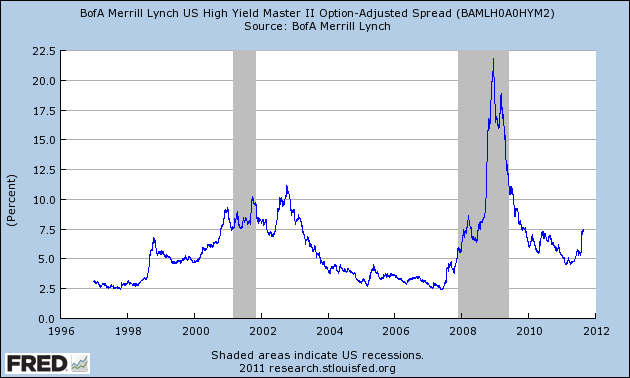

If we look at bond markets in general it’s clear that the market has come unhinged. 10 year U.S. Treasuries are yielding just 2%. Greek 2 year notes are yielding over 50%. German 10 years are yielding 1.85%. Japanese 10 years are at 0.99%. High yield bonds are sharply higher in recent weeks:

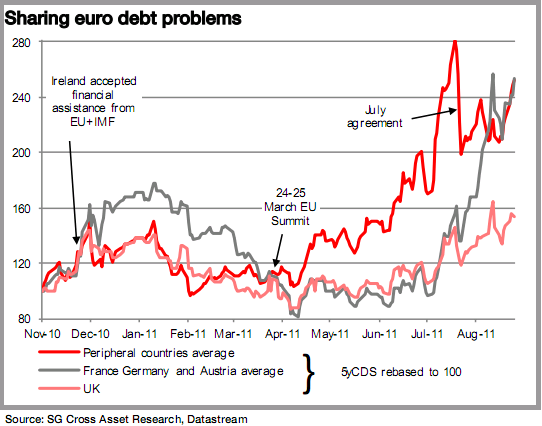

All in all, this is far from a normal environment. If one looks merely at bond markets the world appears to have been turned upside down. “Broken” is practically an understatement. If we look under the hood at the current environment, the sovereign and corporate bond markets barely tell the story of the turmoil that is brewing. When it comes to credit, it’s clear that Europe is broken and other markets are just following their lead. As I noted a few days ago, the CDS market is already screaming that the European banking woes are worse than 2008. SocGen elaborated on this last week:

“The European debt crisis won’t be resolved with yet another summit. The new European bail-out agreement

on Greece from last July pushed European AAA countries CDS higher but failed to reassure markets. On one hand, Germany is opposed to Eurobonds and considers that the only solution is more fiscal tightening, and, on the other hand, peripheral countries cannot do much more given current levels of social unrest. The ECB’s announcement that it is buying peripheral bonds has sent 10-year yields lower for these countries, but, with many elections coming soon, the eurozone will probably face further turmoil in the coming months.”

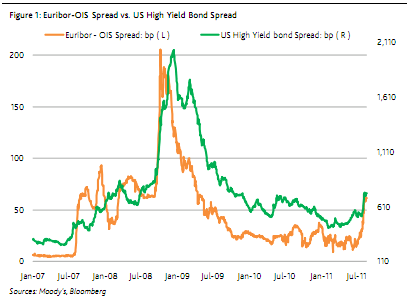

If we dig even deeper into the European story we begin to see even more worrisome signs. In a recent research note Moody’s highlighted the surging Euribor-OIS which is eerily reminiscent of 2008:

“European bank lending is showing stresses not seen since the ending of the recent recession, which casts a pall over global demand for high-risk assets. Excess interbank lending costs, as measured by the Euribor-OIS spread, are up sharply.The Euribor-OIS differential now stands at 61 bp, compared to this year’s low of only 8 bp. The current level is near its widest level since May 2009. European Central Bank purchases of sovereign debt and special bank lending facilities have formed a dam that is preventing a broad market collapse. US high yield credit spreads have closely mirrored fluctuations in European bank funding markets over the past few years (Figure 1). Now at 729 bp, the average spread on US high yield bonds is near its highest level since October 2009. The Euribor-OIS spread is only marginally below its Q4 2007 average of 67 bp that reflected the clamping up of credit markets. This signal of disappearing liquidity fed into the recession and the steady rise in defaults. More confidence in a lasting solution for the eurozone crisis will be needed to alleviate banking sector pressures, and to bring the US high yield spread back toward its historical average of 517 bp.”

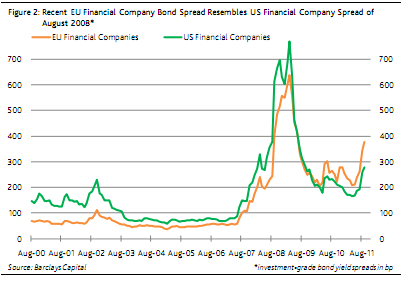

In their latest weekly credit update they again highlighted the importance of not ignoring these warning signs:

“The importance of bank bond spreads to the functioning of capital markets cannot be understated. Stubbornly wide bank bond spreads question the adequacy of financial liquidity for all borrowers in the event of an adverse macro shock. An elevated level of uncertainty surrounding access to financial capital implies that both businesses and consumers will be more “risk averse” than otherwise. An atypically acute aversion to risk will curb capital spending, hiring activity, and purchases of big ticket items, especially housing. Put simply, the attainment of a respectable economic recovery seems all but impossible as long as the credit spreads of high-grade financial company bonds remain extraordinarily wide. Getting both real economies and financial markets back to normal requires a renewed narrowing by high-grade financial company spreads from their now below-investment-grade widths.”

This all makes sense when one understands that the construction of the Euro is so fundamentally flawed. As I’ve stated on many occasions, the EMU is inherently flawed in its construction. Without a stabilizing mechanism (floating exchange rates or a central treasury) the nations in Europe will continue to operate as currency users rather than currency issuers. This lack of monetary sovereignty ensures that the solvency concerns will continue to exist without any of the individual nations being able to combat the inevitable problems that come with being a currency user.

Going forward, there is only one solution for Europe. They MUST solve the issue of sovereignty. This can only be done in one of two ways – they create a full monetary union similar to the USA or they dissolve the union and essentially recreate the old currency system. Unfortunately, European leaders can’t agree on a workable solution and the problems are now metastasizing. Europe is broken and as long as they continue to kick the can the problems will grow until the markets force EMU leaders to create a real solution. Until then, risks in the markets are going to remain highly elevated.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.