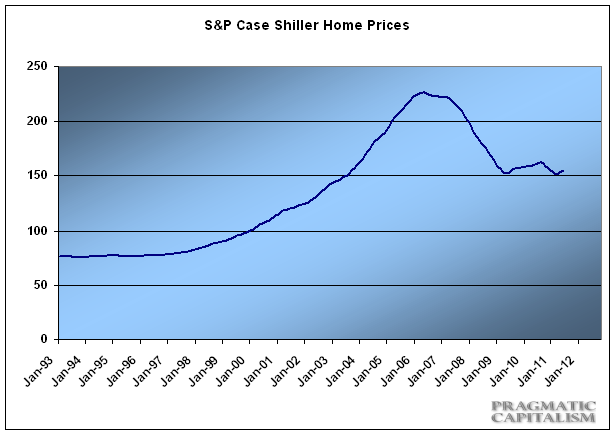

The latest Case Shiller home price data is showing some stabilization in prices. This shouldn’t come as a huge surprise as seasonal factors tend to play a large role in the Q2 data. All in all, housing remains over 30% from its highs set back in 2006 and remains one of the primary factors leading to the consumer crunch (S&P reports):

“Data through May 2011, released today by S&P Indices for its S&P/CaseShiller Home Price Indices, the leading measure of U.S. home prices, showed a second consecutive month of increase in prices for the 10- and 20-City Composites. The 10- and 20-City Composites were up 1.1% and 1.0%, respectively, in May over April. Sixteen of the 20 MSAs and both Composites posted positive monthly increases; Detroit, Las Vegas and Tampa were down over the month and Phoenix was unchanged. On an annual basis, Washington DC was the only MSA with a positive rate of change, up 1.3%. The remaining 19 MSAs and the 10- and 20- City Composites were down in May 2011 versus the same month last year. Minneapolis fared the worst posting a double-digit decline of 11.7%.”

Source: S&P

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.