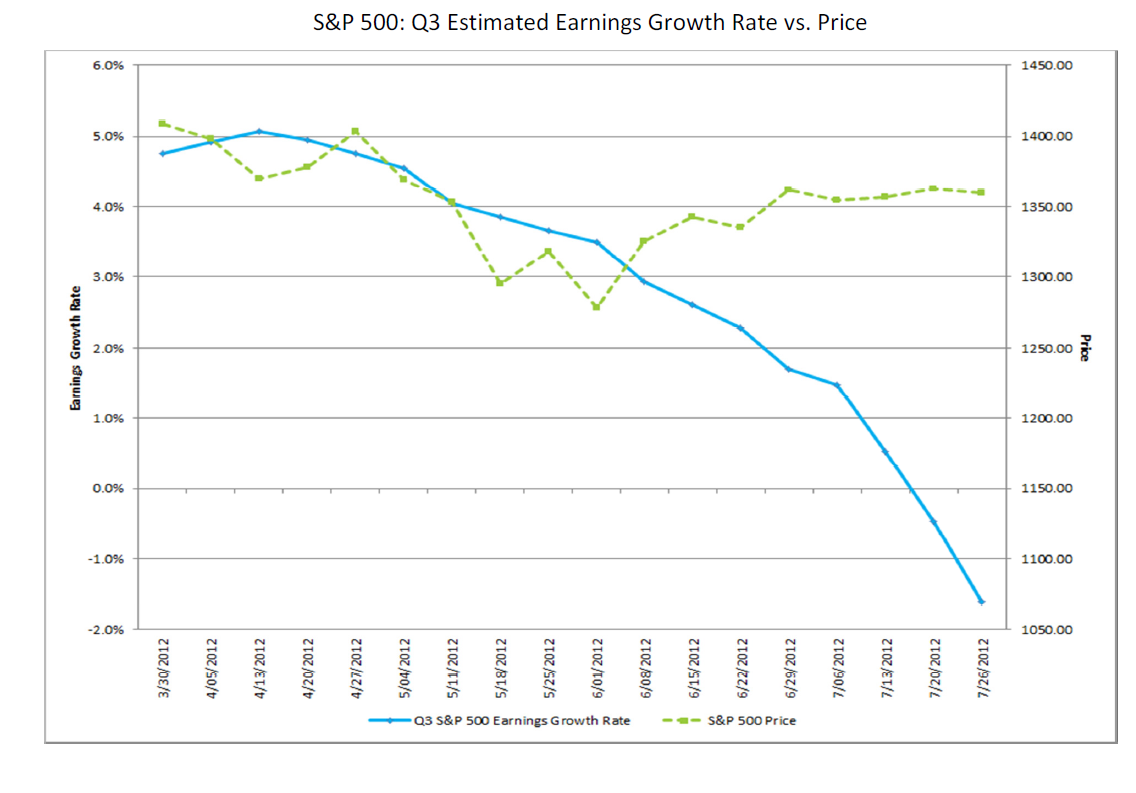

This earning’s season is starting to raise some red flags. As expected, corporate profits are starting to show some serious signs of deterioration. Q3 is expected to show a year over year decline in earnings now and Q4 is expected to show a sharp bounce back. As uncertainty is likely to persist into Q3 I would expect those Q4 estimates to come down some. Factset has some details on this quarters earning trends:

“Of the 265 companies in the index that have reported earnings to date for Q2 2012, 71% have reported actual EPS above the mean EPS estimate. This percentage is consistent with the average over the past four quarters (72%). In terms of revenues, just 43% of companies have reported actual sales above estimated sales. This percentage is well below the average over the past four quarters (63%). If 43% is the final percentage, it would mark the lowest number since Q1 2009 (37%).

The blended earnings growth rate for the S&P 500 for Q2 2012 is 3.3%, slightly above last week’s growth rate of 3.1%. The improvement in the growth rate is mainly due to upside earnings surprises from companies in the Industrials (Caterpillar) and Telecom Services (AT&T) sectors, partially offset by downside earnings surprises from companies in the Information Technology (Apple) and Energy (ExxonMobil) sectors.

…

Looking ahead, companies and analysts have reduced earnings estimates for the 2nd half of 2012 since the start of the third quarter. In terms of guidance for Q3 2012, 47 companies in the S&P 500 have issued negative EPS preannouncements to date while just 13 companies have issued positive EPS preannouncements. Analysts now expect a year-over-year decline in earnings for Q3 (-1.6%). Despite cuts to estimates, analysts still project double-digit earnings growth (11.1%) for Q4 2012.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.