When all is said and done with the Trump Presidency I suspect we’ll remember the era as “The Trump Bubble”. As I outlined earlier this year and on election night last year, it just makes too much sense – big talking business man comes in and implements a bunch of business friendly policies all the while exaggerating the impacts and stoking a sense of (relatively) false positivity in the economy. Investors, already sitting on a massive 8 year bull market soak it all in, bid up prices more, businesses join the party and the boom turns into a very big (market) boom which creates a price compression and an eventual price depression.

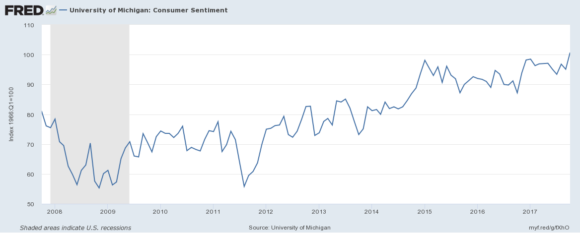

To visualize this we can look at sentiment relative to the financial markets. Consumer sentiment is showing its strongest readings in the last 10 years:

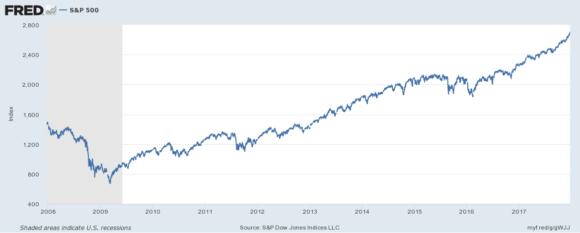

And the S&P 500 has surged to all-time highs:

So, animal spirits igniting? Check. Financial markets surging? Check. Now, the real question is how much of Trump’s policies will actually trickle down to the bottom line of Corporate America and will the price disconnect in the financial markets be so great that an inevitable correction occurs when investors realize that the big talker was more talk than walk? I guess we’ll just have to wait and see, but so far it all seems to be playing out as expected.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.