By Cullen Roche

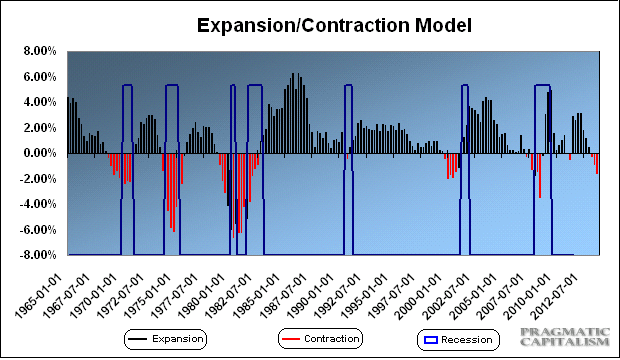

Recent data has shown some signs of weakness in the broader economy, but this doesn’t change my long held outlook on continued growth and no recession. The latest update to my expansion/contraction model is showing growth just shy of 3% in H1 20112 and averaging just 1.5% in H2. This comes out to a little over 2.25% for the year. Not bad, but clearly not great either. We’re still muddling through. The bad news comes in 2013.

The model is currently showing a recession to officially begin in Q2 2013. This largely due to the outlook for substantial decline in deficit spending as growth in credit and investment remain very weak into 2013. In the last 50 years the model has never experienced two negative quarters without a recession following. The current forecast shows two official contracting quarters in Q2 & Q3 of 2013. So we have some breathing room for now, but the risks are mounting as the years goes on.

The upside risk to this forecast is a potential boom in credit and investment while the downside risk is an acceleration in the size of the deficit. As of now I would wager that the odds of sharp contraction in the deficit heading into 2013 are lower than the CBO is currently forecasting. Additionally, recent real estate data and credit trends are showing some signs of stabilization. In my opinion, this means we could see upside risk overall to this model. Nonetheless, while the effects of the balance sheet recession are definitely waning, the depth of this recession and the dramatic negative impact will continue to impact the economy well into 2013.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.