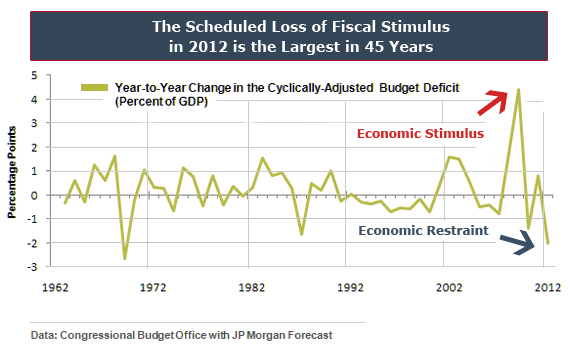

A recent Business Insider story by James Cooper beautifully mapped out the current path the US economy is headed down. With or without debt ceiling austerity, the U.S. economy faces a massive fiscal headwind in the form of stimulus withdrawal. Mr. Cooper explained how the US economy was set for the largest withdrawal of fiscal stimulus in 45 years:

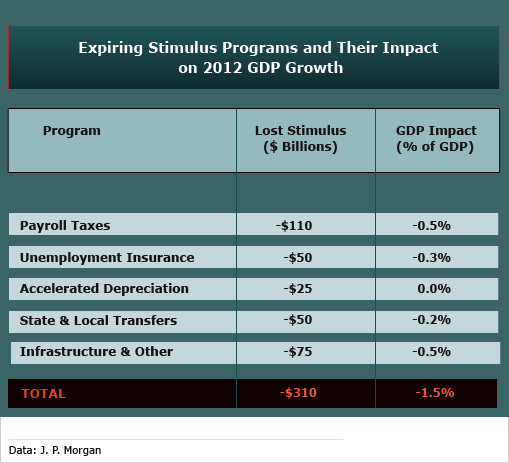

“When 2012 begins, the economy is already scheduled to lose more than $300 billion in federal support, as several programs aimed at propping up growth in recent years expire or fade away by the end of this year. Policy changes now on the books will result in the most severe fiscal tightening in more than 40 years, subtracting an estimated 1.5 percentage points from GDP growth next year, according to an analysis by economists at J.P. Morgan Chase.

…Expiring programs will help to reduce 2012 deficit but at a heavy cost to the economy, especially in the first half of the year. So far the private-sector, which has grown by a modest 2.9 percent over the past year, has not shown the oomph needed to absorb a 1.5 percentage point hit to GDP growth while also supporting a growth rate strong enough to reduce unemployment. For example, for the economy in 2012 to make the mid-point of the Federal Reserve’s 3.3-to-3.7 percent growth projection, private-sector GDP would have to grow 5 percent, a pace not achieved since the tech-stock boom more than a decade ago.”

I like to think of the US economy as having cancer. What we did in 2009 was inject the patient full of percocet. It felt great. And we injected enough of it that it’s actually lasted longer than most thought. But we have to recognize that the doctors in this Emergency Room (Dr. Bernanke primarily) never actually diagnosed our problems accurately and therefore never actually removed the cancer. Dr. Bernanke misdiagnosed our household debt crisis as a banking crisis. And his (mainly) monetarist policies have done little to help the patient. Fiscal policy, while effective (according to the independent CBO) was very poorly allocated again because we misdiagnosed our disease. In 2009 I described this effect and how it could lead us to make a future policy mistake resulting in a longer lasting recession than most believed possible:

“The underlying problem was not that rates were too high or that there were no stimulus packages already in place – the real underlying problem was that there was too much debt at the private sector level. That problem still exists and had already spread throughout the system by the time the Fed began to act. Nothing was done about it. All we’ve done is inject the patient with enough Percocet to put an elephant to sleep. In other words, the patient feels better, but the cancer is still there.”

So what’s beginning to happen now is that the patient is still suffering from the same disease, but is experiencing horrible withdrawals as the drugs wear off and the sick patient is once again revealed. This is frighteningly reminiscent of 1937 and the repeated mistakes of fiscal withdrawal in Japan. It’s incredible to me how Japan has essentially given us the playbook for this crisis and we are simply repeating many of their mistakes. Granted, we are Japan on fast forward, but that doesn’t make the lack of a rational policy response any more excusable.

For now, it looks like the budget deficit remains large enough to sustain below trend growth that results in a muddle through economy and what will continue to feel very much like a recession as private sector de-leveraging impedes growth. But as we head into 2012 the risks are skewed to the downside. If austerity from the debt ceiling debates turns out to be material, we could find ourselves confronting a very Japanese-like future.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.