Whenever the stock market falls people always try to explain why. The honest answer is “no one knows”. We don’t really know why the stock market rises and falls on any given day. There can be any multitude of unknown factors that lead to stock price increases and decreases. Maybe it snowed in NY? Maybe Donald Trump tweeted a lot from the toilet? Maybe a Credit Suisse VIX ETF blew up. Who knows? The needle can move in one direction for lots of reasons.

The one thing we know for certain is that prices move because one side of buyers/sellers is more eager than the other. Again, we don’t really know why that is, but it’s the only factual matter that causes prices to change.

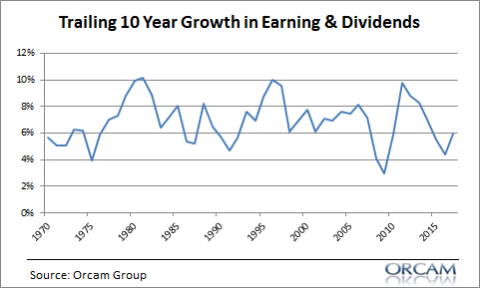

Now, the interesting thing about stocks is that they generate surprisingly stable earnings and dividend yields. Here’s the trailing 10 year growth in earnings and dividends:

In other words, if there is no change in multiples then stocks have pretty consistently earned 4-10% in earnings and dividends. That’s a fairly reliable 7% earnings and dividend yield. So, we can guess that stocks will probably go up more often than not because the underlying entities earn cash flows that mathematically lead to higher prices. If you hold stocks for a long time then the odds of benefiting from that positive earnings and dividend trend is pretty high.

Now, I know some of you hate it when I do this, but I love to think of stocks as super long duration high quality bonds because it puts the math in simpler terms (at least for me). For instance, a 10 year AAA rated bond yielding 2% will go down about 10% if interest rates rise by 1%. You’ll still get your 2% per year, but if you’d bought that bond one instant after if fell in price then you’d own the exact same high quality instrument with a higher yield to maturity than the 2% yielding bond. At the same time, if yields fall by 1% then your 2% yielding bond will rise in price by about 10% and the person who buys that bond one instant after you will earn a lower yield to maturity. In the latter case you earn about 5 years worth of coupons all in one instant while the buyer at lower yields has to wait 10 years to earn the same 10%.

Now, the same basic thing happens in the stock market across time. As market conditions change we are guessing what that should mean for current prices. If the stock market goes up 20% a whole bunch of years in a row then the market is earning much more than its average coupon. The longer it does that the higher the probability is that it’s unsustainable. So, it’s a lot like our 2% yielding bond that goes up 10% in an instant. When that bond rises 10% it must earn lower future returns because it isn’t designed to earn 10% every single year. And if the market is wrong about the interest rate change then the bond could correct by 10% and you’ll just have to wait the full 10 years to earn your 2% annual return.

The stock market is not that dissimilar in that it can’t mathematically earn 20% every year. And sometimes it overshoots or undershoots that average 7% because that 7% isn’t very consistent.¹ But the thing that you’ll notice consistently about big market declines is that they’re almost always preceded by big increases. In other words, we sometimes think the market is going to earn more than that 7% so we bid prices way up at an unsustainable rate and then reality hits us over the head and the market corrects to adjust back towards the average rate of return. Everyone wants a fancy sounding story for why the stock market goes down, but in most cases it’s as simple as “because it went up a lot”.²

¹ – Also, the buyers of stocks are just a bunch of crazy apes who don’t really know the value of the instruments to begin with so the price is inherently volatile because we’re all just kind of guessing as we go….

² – The opposite can also be said in many cases. The stock market often goes up a lot because it went down a lot.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.