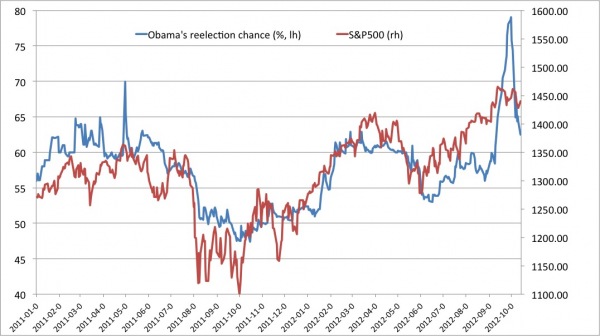

I’m not sure whether to laugh, cry or throw this in the “dataming” bin. The chart below comes from Lars Christensen’s blog. It shows the S&P 500 vs the re-election odds of President Obama. As you can see, the correlation is extremely close. Now, Mr. Christensen is a market monetarist and they’re pretty fond of the idea that stocks can create a “wealth effect”. He also implies in this post that stocks accurately represent the economy:

“This is the real-time version of James Carville’s famous dictum “It’s the economy stupid”. It is not a forecast on the election outcome – as I have no clue where the stock market is going in the coming weeks, but it is an illustration that TV debates are much less important than how the economy is doing.”

I personally don’t think stocks are an accurate reflection of the economy or that there is any supposed “wealth effect” from equity price increases. On the latter point, equity prices are merely nominal paper gains. To live your life based on these gains (which only a very small portion of the population does) is to put the cart before the horse. That is, this nominal wealth exists on paper, but is not real until the gains are realized. For most of us, that means we’re counting our chickens before they’ve hatched. On the first point, I’d only repeat my belief that stocks are essentially the summation of a bunch of guesses from inefficient participants with totally inadequate information.

But the strangest part in all of this is that human beings suffer from such a horrible case of recency bias that we can’t seem to see past the last stock quote we last saw on Yahoo Finance. This isn’t a knock on Obama. He’s performed OKAY in a pretty tough environment (though disappointing in my book for various reasons). I just think it’s another case of inefficient humans at work assuming that a better stock market today means the world is a better place. It’s almost like all these people making that assumption just went and missed the fact that capitalists, being capitalists, have responded to the weak economy by notching up record profits in large part by firing the very people who helped boost their profits (ie, they fired so many workers that their profit margins went through the roof)….Oh, the irony!

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.