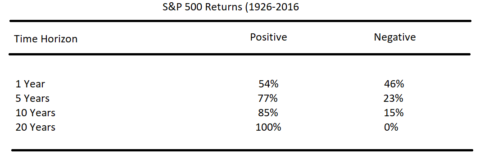

It’s become popular during the last year to argue that “stocks only go up”. And yes, it sure feels like that some times. In fact, in the long-term, it’s mostly true. The odds of you losing money in the long-term are low:

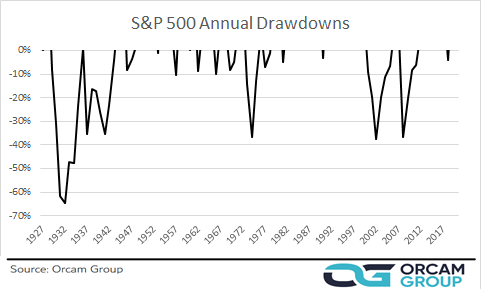

The problem with this view is that we don’t live our lives in the long-term. We live our lives in the short-term and a large portion of our financial liabilities are short-term – our rent, mortgage, car payments, etc. In financial portfolios we have what is called a perpetual asset liability mismatch. That is, you have certain short-term and long-term liabilities that you need to match with certain short-term and long-term assets. None of us can match those liabilities perfectly because we don’t really know what they’ll look like across time. And while the stock market is a wonderful long-term asset it is often a horrible short-term asset. For instance, consider the long-term chart of stock market drawdowns:

Within this time horizon you have multiple 5-10 year drawdowns and one devastating long-term drawdown. More importantly, I am intentionally ignoring the fact that the stock market regularly endures 20%+ drawdowns on a monthly basis. The investor who slept through 2020 didn’t even know that, at one point, the S&P 500 was down 35%. And that’s very important to recognize in all of this because the stock market, while being a long-term instrument, can create a disproportionate amount of short-term angst. In other words, if your asset liability mismatch is way off (meaning you’re overly exposed to stocks) then you exacerbate the risk that a COVID style drawdown will create excess behavioral risk for you because you are more exposed to the potential reality that a short-term drawdown turns into a long-term drawdown which creates months or even years worth of portfolio and income uncertainty.

The problem with narratives like “stocks only go up” is that it fools people into chasing returns when they are mostly chasing risk. Now, this might not be bad for some people. If you are young and risk tolerant then that might be a fine view. But for most of us we either don’t have the risk tolerance or we don’t have the runway required to endure a 5 year drawdown and all the uncertainty that comes with it. So we have to accept a little less risk knowing that we might forego some return. Life is all about tradeoffs and one of those tradeoffs is recognizing that the stock market not only doesn’t “only go up”, but in fact recognizing that sometimes it MUST go down in order to make the upside sustainable.

It’s important to remember this when the market is good because the worst time to discover this reality is when the market is bad. We prepare for the bad times during the good times. So be wary of this narrative that stocks only go up. It’s just not true.

Related:

Problems with “The Short-Term”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.