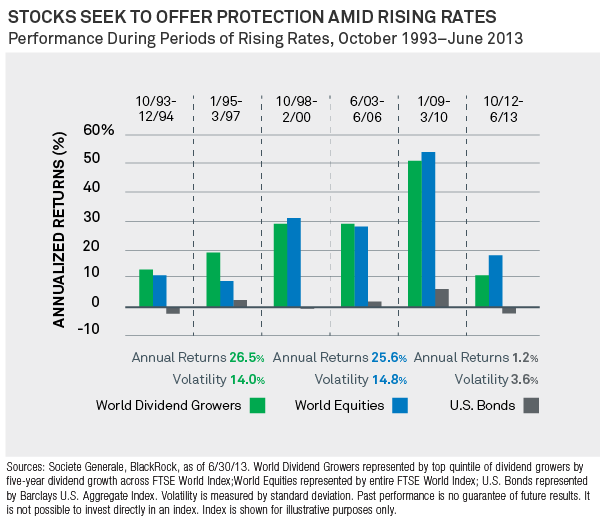

There’s a good deal of fear in the current environment about rising interest rates. BlackRock provides us with some nice perspective though. It shows a few of the recent rising interest rate environment. Two things really stand out here: 1) bonds haven’t performed all that poorly in absolute terms during rising rate environments. And 2) stocks are a substantial hedge against rising interest rates. Here’s a bit more from BlackRock:

Most investors fear rising interest rates. But perhaps more than the others, bond investors fear the loss of portfolio value that may occur when interest rates rise. Which begs the question – are there alternatives to bonds that might offer income and behave better in a rising rate environment? Indeed, global dividend stocks offer a compelling potential of income and outperformance in rising rate environments.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.