As the economic malaise in the developed world continues there are increasing signs of overheating in parts of the emerging world. China’s GDP continued to soar according to their latest GDP data. Inflation was more muted, however, the surging aggregate demand is likely to continue pressuring prices. In reaction to the report, Goldman Sachs said the response from the Chinese government will be continued tightening:

“We believe the worst growth-inflation combination is probably behind us as supply side restrictions will likely become less stringent going into 2011. However, we believe even if all supply side restrictions were lifted, inflation pressures will not disappear because current level of aggregate demand growth is too strong. Given our expectations of continued improvements in external demand and China is unwilling to fully utilize exchange rate as a policy tool to affect exports, the only option is to tighten domestic demand especially via tighter domestic liquidity.”

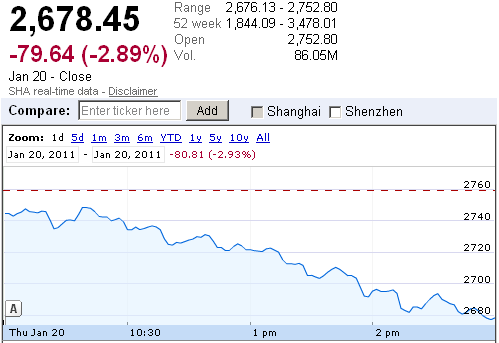

This was certainly the fear in equity markets overnight as Chinese stocks once again got slammed -3%. It remains a very uneven global recovery and there is likely no greater downside risk than the way the Chinese handle their inflation woes.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.