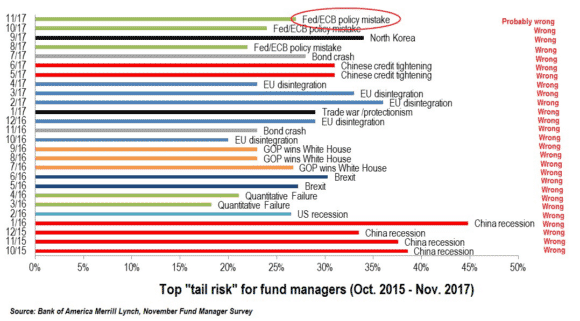

Half of the battle in portfolio management is wading through the sea of BS narratives that we are bombarded with on a daily basis. Knowing which narratives to avoid can be even more important than knowing which narratives are actually useful. Many of the stories I write here involve me thinking out loud about much of this BS. So I had a good chuckle when I saw this list of “tail risks” from the most recent Merrill Lynch Fund Managers Survey (I added the lovely “wrong” column and I was apparently drunk when I did so because it’s pretty crooked):

Tail risks are low probability events so they should be hard to predict. But the interesting thing about this list is that it’s filled with tons of BS narratives. In fact, regulars will recognize many of these because I wrote about many of these in real-time (like the low risk from Fed balance sheet reduction, the probability that Trump was good for the stock market, the myth of the bond bubble, etc). Don’t get me wrong. Some of the things listed here are serious risks like the North Korea risk. That’s a very real tail risk, but we have to be careful separating the BS narratives from the real risks.

Now, the tricky thing with assessing tail risk (and risk of any type) is that it really can’t be quantified. No one knows what the chances of a nuclear strike are. Heck, the data on how poorly active management does shows just how hard it is to predict what the markets will do. Then again, any smart investment manager has to assess potential risks. If the world involved no risk management then we’d all just lever up long and wait for the inevitable portfolio imploding bear market before we were reminded that risk management matters. But how do we separate the BS narratives from the real risks?

1. To begin with, most indexers probably have no need for assessing tail risks. A true buy and hold indexer must accept that the markets have always gone through huge ups and downs. There is no shortage of challenges for mankind to overcome throughout its history and given an appropriate time horizon we do always overcome them.¹

2. Tail risks are virtually impossible to predict by definition so while it’s a nice exercise to undergo it’s an exercise in futility to try to constantly predict things that are hard to predict by definition. Of course, this doesn’t mean that we should throw risk management out the window, but you can insulate a portfolio from tail risks without having to predict the precise tail risk.

3. Avoid the story tellers and politics. The second someone starts talking about politics, the Federal Reserve’s “manipulation” of the stock market, etc. your warning signals should start to blare. These stories involving politics and politically motivated narratives are almost always biased BS.

4. Avoid narratives that rely on short-term outcomes. Oh, you think the election is a big risk and you think you can predict when the market will discount that risk and by how much? No. You. Can’t. The reason short-term trading is so difficult is precisely because you have to not only get the narrative exactly right, but you have to predict WHEN that narrative will be discounted. Perhaps not impossible, but very very difficult to consistently predict.

5. Assess risks based on empirical evidence. For instance, we know that high valuations tend to mean lower risk adjusted returns going forward. This is a solid empirical data point. Always defer to empirics where you can.

6. Understand first principles and operational realities. One of the reasons I write so much about first principles and operational realities is because it’s a fantastic way to tell when people are bullshitting. For instance, when people said QE would cause high inflation we knew that was a bullshitter narrative based on the money multiplier. It’s just not how banking works and understanding operational realities helped us know that.

Anyhow, I am starting to ramble here as my mind begins to wander off to dreams about stuffing, turkey and pies so I’ll let this one rest. I hope you found it a little bit helpful.

¹ – We might find out if this theory holds true when Little Rocket Man gets pushed too far. Then again, I doubt any of us will care too much about our investment portfolios in that world. It’s also worth noting that most people aren’t or can’t afford to be pure buy and hold indexers with super long-term time horizons.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.