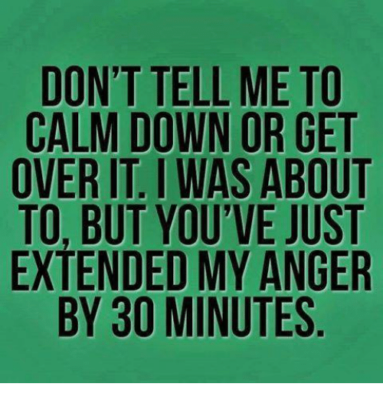

I’ve been with my wife for 17 years. And after all that time I finally figured out something really important when we’re fighting – never, never tell her to calm down when she’s mad. You see, this is very important because I am almost always the cause of her anger. Telling her to calm down after I made her mad is like shooting someone in the belly and telling them not to bleed. Read on because there’s a useful investing analogy somewhere in here….

The all world stock market is down 9.7% from its January peak and 7.5% from its September high. Outside of a handful of US tech stocks it’s been a fairly crummy year for the global stock market and after a record setting bull market you might be wondering if the end is near.¹ Worse, you might be reading some scary narratives that this is the beginning of the big one. Maybe it is. I don’t pretend to know. That’s why I advocate diversifying in low cost index funds and rebalancing portfolios to protect us from the procyclical risks in stocks.

But I have to be honest with you all about something. Every time I see a downturn in stocks I see an army of pundits, advisors and journalists telling people not to panic and to think about the long-term. This is mostly right, but I also think it’s not nearly good enough. After all, if you’re allocated too aggressively going into a bear market then there’s no amount of hand holding and long-term thinking  that is going to make you feel comfortable with what’s going on in the short-term. And this is the crux of my gripe with this commentary – if you’re panicking in the first place then constantly being told not to panic is not good enough.

that is going to make you feel comfortable with what’s going on in the short-term. And this is the crux of my gripe with this commentary – if you’re panicking in the first place then constantly being told not to panic is not good enough.

Being told not to panic while you’re panicking during a bear market is like getting on a rollercoaster that’s a lot scarier than you thought and then having your rollercoaster advisor tell you not to panic while you’re in the middle of having a heart attack during a downturn. This. Is. Not. Good. Enough.

The time to prepare for a bear market is during the bull market. After all, everyone is a comfortable genius during a bull market and most people turn into panicked fools during bear markets. And yes, while it’s precisely right to tell people not to panic during the downturn of a rollercoaster it’s even more important to make sure you’re not getting on a rollercoaster you aren’t comfortable with.²

¹ – If you’re still reading end of world blogs after all this time then I don’t know what the hell you’re doing here.

² – This article should not be misconstrued as relationship advice.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.