Here’s a great new piece of research from the NY State Comptroller discussing the USA’s balance of payments. A lot of people don’t know it, but the USA is like 50 little countries all using the same currency. So we have trade imbalances that occur between the states. Those trade imbalances can’t be resolved by foreign exchange movements because we all use the same currency. So the perpetual current account deficit states have to be helped out otherwise they’d become Greece.

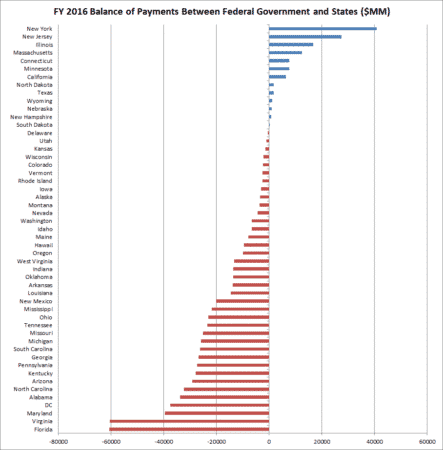

Let me try to explain that in even simpler terms. Basically, states like New York are like Germany. They produce a lot and pay a ton of taxes into the Federal Government’s coffers every year. They also get less in Federal expenditures than they pay in. So they are a net giver to the Federal Government. A state like Florida, on the other hand, is a net recipient as they pay in less than they get. Basically, Florida doesn’t produce as much as they earn so they get more Federal aid. They need this federal aid because they don’t have a currency that can become devalued so their output can become more attractively priced relative to New York’s so the balance of payments can correct over time.

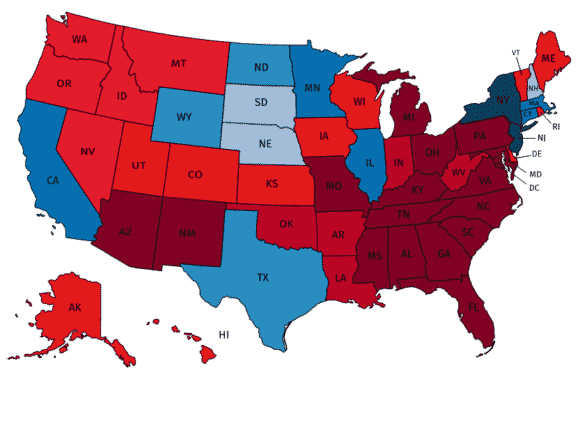

This is a cool arrangement because Florida can be a net taker and never really have to worry about its solvency because it’s getting help from its friends (the rest of us). Now, this might sound like a raw deal for all those blue states in the picture below but it actually works out to New York’s benefit because many of New York’s customers are probably from Florida and the Federal aid they get means that Florida can remain solvent and not have to worry about dragging New York into some sort of recession once every few years because it doesn’t have funding.

Basically, a little redistribution makes the whole system more stable and results in more consistent growth with all the benefits & cost savings we have from using the same currency. If we didn’t have this system of redistribution then all those red states in the bottom right hand of the picture would go into recession much more often and they’d inevitably suck down the blue states with them as the blue states experienced reduced aggregate demand. But we don’t have to worry about that because the blue states’s poker chips get taxed more heavily and so the game goes on rather than coming to a screeching halt once every few decades because some of the players run out of chips.

Here’s the overall breakdown for more perspective on how this looks:

(Click to enlarge)

Anyhow, it’s always an interesting perspective especially with everything going on in Europe. You can see how a system without this redistribution slows to a halt because there’s a recurring crisis in the current account deficit countries. And I hope you don’t take this as some sort of politically motivated post. I really think it’s a rational perspective and the US monetary system is a genius construct that displays how well a single currency system works within a large and complex country. Then again, I know we all basically hate each other now, but we really are better off being unified. Let’s hope it can stay that way.

Updated Source: BOP in the Federal Budget

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.