The latest from James Montier is out and as is always the case, it’s excellent. Here’s a snippet:

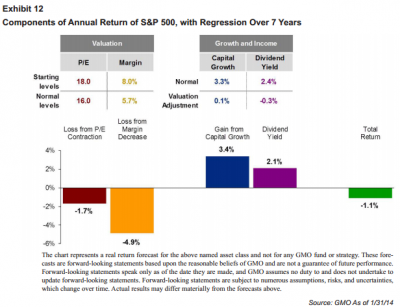

“As a general rule we average across the various models we use to generate our best forecast as to where real returns are likely to head, rather than relying upon one signal model (without exceptionally good reason). Doing so currently results in our expectation of a -1.1% real return for the S&P 500 over the next seven years (see Exhibit 12). We continue to believe that the weight of valuation evidence suggests the S&P 500 is significantly overvalued at its current levels. Some call us “valuation bears”; we argue that we are simply valuation realists!”

Read the full piece here. If that link doesn’t work you can access it through the GMO website.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.