You should read this post by Jesse Livermore on profit margins (you can also find him on Twitter here). He goes through a meticulous macroeconomic analysis of the corporate profit margin debate, how it’s been misleading, how it’s been useful and how to improve it. Here’s a snippet of some of my favorite parts, but you should spend some time reading the whole thing:

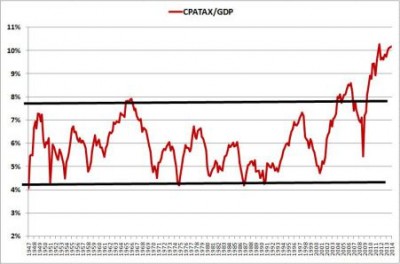

This latter chart, CPATAX/GDP, and that of its twin brother, CPATAX/GNP, is anillusory result of flawed macroeconomic accounting. In the paragraphs that follow, I’m going to try to clearly and intuitively explain why. Hopefully, the chart will disappear once and for all.

…

For investors, refusing to respond to changes in reality will lead to destruction. Reality will not tolerate it. If a variable that allegedly mean-reverts refuses to revert over long periods of time, then we need to acknowledge the possibility that the variable is not naturally mean-reverting, or that the mean that it naturally reverts to has changed. Economics is not physics. There are no “divinely-ordained” constants that govern the system. The averages that economic variables exhibit, and the settling points towards which they gravitate, can and do change as secular conditions in economies change. This fact is true of almost anything “economic” that we might measure–growth rates, interest rates, inflation rates, asset valuations, and profit margins.

…

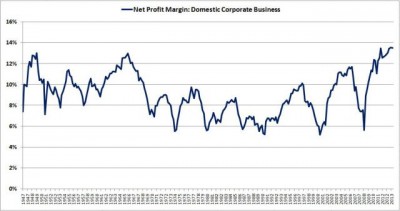

Utilizing the data in NIPA Table 1.14 (FRED), we end up with the following chart, which is the only accurate NIPA chart of net profit margins for the macroeconomy, and the only NIPA chart that anyone should be citing in this debate.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.