Seven years ago Ted Seides made a bet with Warren Buffett that a fund of hedge funds could outperform the S&P 500 over a ten year period. As of today, that bet is looking very bad with the S&P 500 beating the fund of funds by over 40% (63.5% vs 19.6%). Seides wrote a piece for CFA Institute explaining why the bet has been wrong and some lessons from it. While Seides makes many good points there’s one lesson that is particularly important in all of this:

STOP PAYING HIGH FEES

Seides explains that half of the underperformance is from fees:

Just over half (24.4% ÷ 43.9% = 55.6%) of the underperformance by hedge funds can be attributed to fees. A full 19.5% of cumulative underperformance, or approximately 2.6% per annum, must have been caused by something else.

That’s not exactly a glowing endorsement for high fee funds. Why would anyone pay more for less? The fact is, the investment world has become dirt cheap. You can get good financial advice for a fraction of the fee that you once had to pay. The entire hedge fund industry is living in the past hoping to continue to suck 2&20 out of their unwitting clients for as long as they can. The reality is that you don’t have to pay high fees for smart advice any longer. Heck, I offer my asset management service for a measly 0.35% and I’d say I am a pretty “sophisticated” thinker. That’s what my mother tells me anyhow and I believe everything she says.

More importantly, we’re entering a world where future returns are likely to be lower in the future. With bonds generating low yields a balanced portfolio is either going to produce lower returns in the future or higher volatility returns as more of the gain is made up by stocks. This creates a problem for investors. If you’re paying high fees you’re either paying more for lower risk adjusted returns OR your fees are eating into your returns by an increasingly large margin.

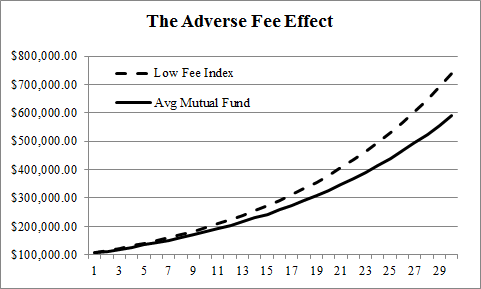

If you’re looking at a real return (after inflation) of 6-7% in stocks then we have every reason to be mindful of any other frictions like taxes and fees that might reduce that return even further. But what is the average fee effect? To put things in perspective consider that the average mutual fund charges 0.9% relative to the average low fee index which charges 0.1%. That’s a 0.8% difference. It doesn’t sound like much, but take a 7% compound annual growth rate on $100,000 and extend that over 30 years. Just how much of an impact does it make? The mutual fund ends up with a balance that is 23% lower than the index. In other words, the mutual fund could just mimic the return of the index and reduce your return by $150,000!

Either way, the solution is simple. Stop paying high fees. My general rule of thumb is that you should almost never pay more than 0.5% for portfolio management. If you’re paying more than that then I highly doubt you’re getting your money’s worth.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.