I have spilled a huge amount of ink about Quantitative Easing and its impacts over the last 5 years (see here). One of my key points about QE is to highlight how it probably hasn’t had as much impact on the broader economy as some people tend to imply. In other words, it’s not as stimulative as many think.

But one thing that’s undeniable is that QE has an impact on asset prices. It not only has a strong behavioral impact, but directly impacts the supply of outstanding assets thereby forcing the private sector into other assets like corporate bonds and stocks. Anyone who says this has no impact on asset prices is ignoring reality.

On the other hand, I do fear that some advocates of the “QE = higher asset prices” have a tendency to imply that there has been no fundamental reason for the rally in stocks. In other words, they imply that the current rally is all a house of cards that is built on fake “money printing” and fake demand.

But this view totally ignores the key driver of asset prices. Yes, you can alter the supply of an outstanding asset, and all else being equal, it will rise in value. But all else is only equal in mythical economic models. All else is never equal. For instance, a company can reduce its outstanding share count thereby boosting EPS and its current price, but if the underlying fundamentals deteriorate then the asset will not likely sustain any boost in price from the buyback. QE is very similar. Yes, the Fed can reduce the outstanding investable assets in the private sector, but that doesn’t mean there can’t be underlying fundamental strength to sustain any rise in prices (although markets can obviously remain irrational for long periods of time).

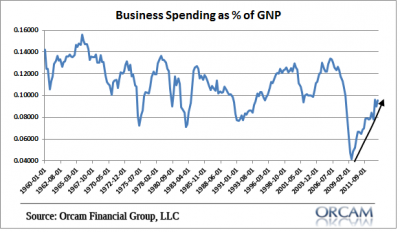

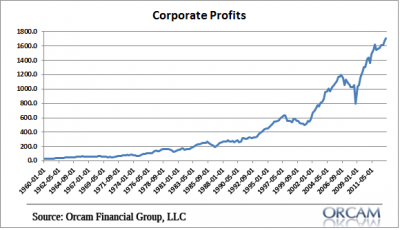

And I think this is a key point that many of the QE alarmists gloss over. There has been real fundamental underlying improvement here. The most important of which is shown in today’s Z.1 Flow of Funds report in the form of business spending and corporate profits.

These two charts prove, without a shadow of a doubt, that there has been real underlying fundamental improvement in corporate balance sheets. We can argue about whether the market is “expensive” or a good “value”, but I think one thing we shouldn’t imply is that the current rally is purely driven by a false underlying driver such as QE. That’s clearly not entirely accurate.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.