Almost every week someone comes to me with the same story:

“Hi Cullen, I am a wealthy older investor who has lived through two stock market bubbles and crashes and moved mostly to cash following the 2008 crash. I’ve been waiting for better prices all the way up and find myself frozen. Stocks look expensive and bonds scare me because of the potential for rising rates. I am frozen in cash and I don’t know what to do…HELP!”

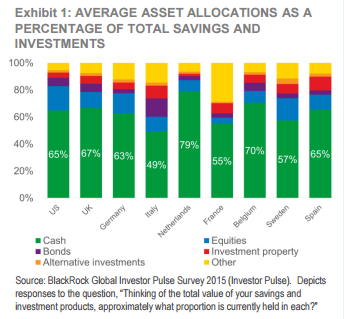

If that sounds familiar you’re not alone. Here’s an amazing statistic from BlackRock showing the huge amount of cash that investors hold:

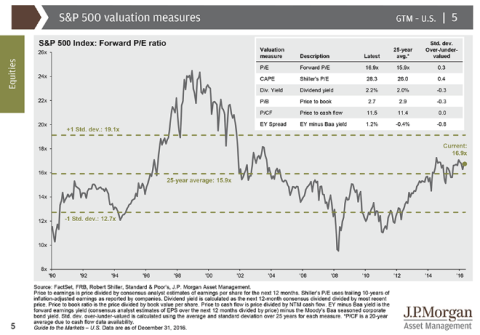

But maybe this isn’t quite as irrational as some people might have you believe. After all, stocks are a bit rich by just about any measure (via JP Morgan):

And then there’s the bond market which is either too confusing for most or too low yielding for the rest. And in a low rate environment we’ve been brow beaten to death by the myth that bonds MUST lose value if rates rise. This isn’t exactly right, as I’ve explained before, but it’s paralyzed many from ever owning bonds.

So, stocks are uncomfortably risky for a lot of people. Cash earns nothing and bonds yield just a tad more than cash, but have the potential for principal loss and volatility if interest rates rise. So, what can we do?

Here’s a couple of thoughts:

- In a world of low interest rates you almost certainly need to be taking some stock market risk because a simple bond aggregate at 2.5% or cash at 0% isn’t likely to meet your financial goals.

- Bonds look scary, but they still serve a purpose in a portfolio, even with low rates. In short, bonds, held to the proper duration will not only serve as enhanced cash positions, but will also offset permanent loss risk in stocks if the stock market should decline.

- The fact that stocks and bonds appear risky does not necessarily mean they are both risky at the same time! After all, if you’re afraid that stocks might tank then you should actually be investing in the most uncomfortable bonds imaginable because it’s the 30 year T-Bond that will shoot to the moon if stocks crater.¹ And if bonds collapse then it’s likely that we’re seeing higher inflation which likely coincides with higher economic growth which means stocks are performing very well.

- Ah, but we don’t know what the future holds. Will stocks collapse? Or will bonds collapse? Or will neither collapse? The good news is that we don’t have to know the answer! But since stocks are the dominant driver of potential downside in any diversified portfolio we need to figure out our stomach for stock market risk and simply use the bond piece to hedge that risk.²

- How much stock market risk can you stomach? This is a deeply personal thing and it’s why I recommend a comprehensive risk profiling. Once I know a client’s risk profile I use a heuristic technique that applies the proper time horizon of one’s portfolio to certain instruments. You can read more about it in this post or if you prefer the long form version you can look here.

- Now you need to overcome short-termism. The real problem of asset allocation is asset/liability mismatch. We have uncertain outflows across across uncertain time horizons that we often apply the wrong instruments to. For instance, too many people own 100% stock market portfolios, an instrument that is an inherently multi-decade instrument, but judge this multi-decade instrument on a daily, monthly or annual period. This is totally irrational! So the key here is to diversify your portfolio in such a way that removes the need for predicting the outcome of stocks or bonds, but also applies the right degree of risk to your personal profile over the appropriate time horizon. Most investors can’t maintain the proper time horizon for their financial assets so they are constantly changing asset managers, strategies, holdings, etc. Unfortunately, short-termism is the ultimate plague to good portfolio management. But if you build an appropriate allocation with low fee and tax efficient funds you don’t have to try to force the markets to work for you. If you’ve allocated the assets correctly you just have to be willing to let the markets work for you.³

¹ – This was one of the key lessons from 2008. When there is a crisis in financial markets the only true safe haven instrument is the US Treasury bond which is a function of the tremendous revenue the US government has access to thereby making it the most viable financial instrument in the global financial markets.

² – For instance, a 60/40 portfolio derives most of its permanent loss risk from the 60% stock component because that is the dominant driver of volatility in the portfolio. As a result, many people who think they’re diversified in a 60/40 are really holding something looks more like a 80/20 portfolio because of its exposure to stocks and their outsized risk of downside volatility.

³ – There are any number of ways to maintain and update such a portfolio over time. I prefer a countercyclical rebalancing strategy over time to better account for the risk in certain asset classes as they apply to someone’s portfolio, but there are many ways to skin this cat. Not that I have any experience skinning cats, but given that I am a dog person this could be something I am interested in learning more about.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.