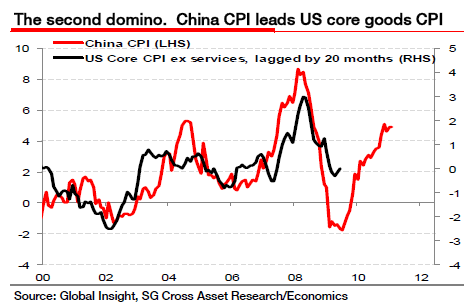

Analysts at Societe Generale are warning that China’s structural inflation is going to begin negatively impacting the USA. They say the inflation dominos are falling as we speak and should translate to higher rates of inflation in the coming years in the USA:

“As China moves into a cycle of generating autonomous structural inflation, it is widely anticipated that China will export this inflation to the rest of the world. Here is how the dominos will fall.

The first domino is China creating autonomous structural inflation:

China attempts to rebalance economy away from investment/exports towards consumption. In March, inflation hit a 32-month high of 5.4% yoy. Policy makers remain well behind the curve. That domino has already fallen.

The second domino (in the process of falling) is proffered to be that China will then export this inflation to the rest of the world. This dynamic seems as inevitable as gravity itself.

The third domino is teetering.

- domestic inflation rising in China

- pace of Yuan appreciation stepping up in Q2-11.

Import price indices from China, for the developed economies, are turning up. Given the “stickiness” of supply, the world will remain a China “price-taker”. The past two decades of outsourcing that turned China into the world’s factory were long term trends. Manufacturing production cannot simply be transplanted quickly to another economy.”

Source: Societe Generale

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.