Last month it was Greece. This month it seems to be China. I said Greece wouldn’t wreck the global economy last month and now no one is even talking about it now. But what about China?

China is a much bigger story for obvious reasons. As of 2014 China was about 15% of global GDP so we’re not talking about Greece here. This is a substantial player in the global economy. But how impactful is China in the USA?

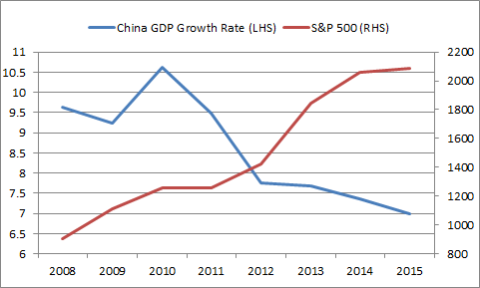

First, it’s important to note that the “China slowdown” story is nothing new. In fact, they’ve pretty much been slowing throughout the entire US economic recovery:

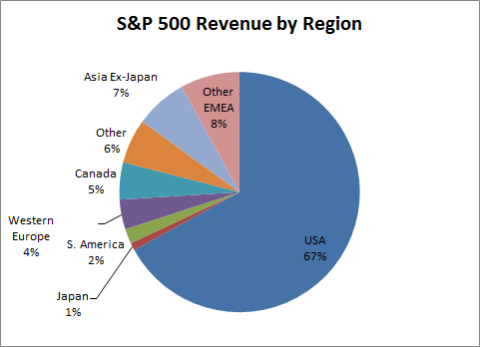

So, why has the S&P 500 just powered right through this China slowdown? Well, China just isn’t that important to S&P 500 revenues. Despite being 15% of global GDP the S&P 500 only generates 7% from the Asia Ex-Japan region of the world.

Lastly, it’s important to keep things in some perspective. It’s extremely odd to be getting worried about an economy that is growing at 7% per year. Most countries would love to have that “problem”. China’s growing even if it’s not growing at the same rate. So, it’s still positively impacting global growth even though the rate of change is slowing. Now, I wouldn’t be shocked if that growth rate were a bit lower since the numbers are almost certainly massaged, but it’s still useful to keep things in perspective. So far, we haven’t seen big changes in the macro data in the USA. This doesn’t mean China will have no impact on US growth, but it’s likely far smaller than the media would have you think.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.