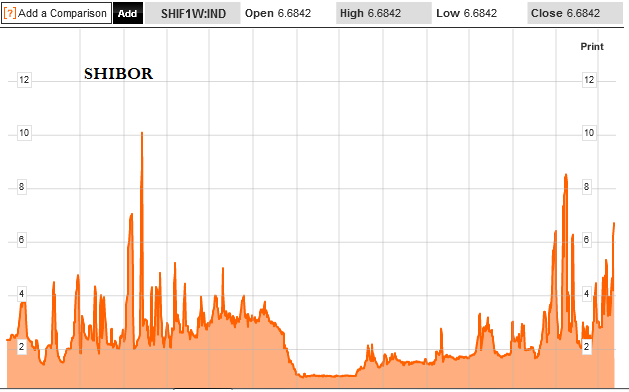

Shibor is blowing out again in China (h/t ZeroHedge). Shibor is the Shanghai Interbank Offered Rate. This is the rate at which banks lend in the interbank market. It’s generally viewed as a sign of stress levels in the banking sector. Latest readings show the rate approaching levels seen only a few times in the last few years:

What’s so interesting about all of this is that it appears to be due to the reckless stimulus and central planning approach implemented by the Chinese government. The Wall Street Journal reports:

“The first wave of problem loans originating from the 2009 economic stimulus is about to hit the banking system. If the reports citing anonymous officials are true, Beijing is considering assuming responsibility for some 2-3 trillion yuan ($300-450 billion) of these loans that were made to local government borrowing vehicles.

The scale of such a rescue is staggering–at about 7% of GDP it is bigger than the U.S. TARP program. It also comes out of the blue; the banks’ audited accounts still show that their nonperforming loans have fallen dramatically. Yet the bailout would nearly equal the total amount of bad loans spun off from the four major state banks during their restructuring in the early 2000s.”

I don’t even know what to make of the actions of these Chinese central planners. Their economy essentially looks like one huge black box built on quicksand. I don’t think anyone truly understands the extent to which this economy is being propped up by government intervention. And no one knows if it is sustainable. For now, the one thing we know is that history has shown that this sort of debt based growth has a tendency to result in inflation and economic imbalances. These situations always resolve themselves in the same way – with economic decline. The extent of the inevitable decline is contingent upon how much this government is propping up the economy. Unfortunately, the black box nature of their economy makes that nearly impossible to quantify. But the risks are apparent.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.