It’s often useful to compare market expectations to reality. After all, a market is not built solely on fundamental realities, but how broadly those realities are expected by investors. When expectations are high there is the likelihood for disappointment. When expectations are low there is a potential for upside surprise. This has been most apparent in my Expectation Ratio which has been consistent with a dramatically improving earnings environment since mid 2009.

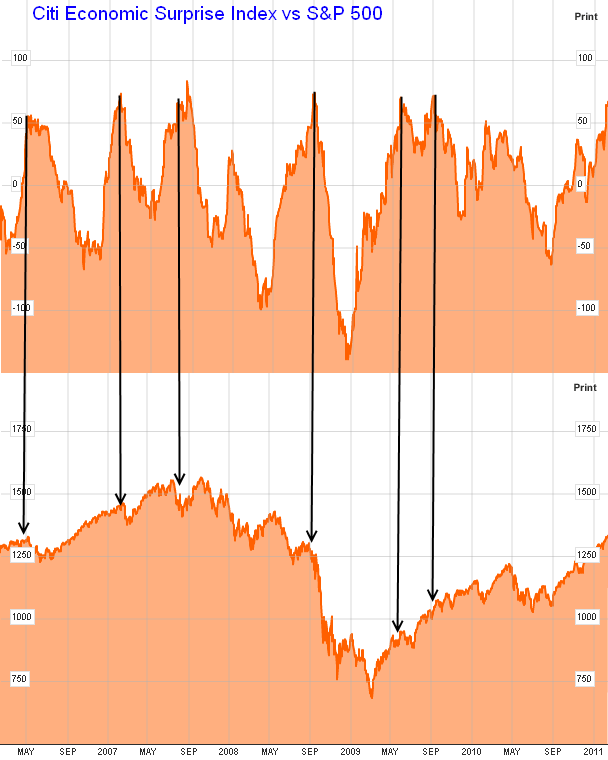

More recently, we’ve seen an increasing level of bullishness in sentiment surveys and analyst’s expectations. CitiGroup tracks an economic surprise index that shows how recent economic reports have been trending versus expectations. Throughout the last 5 years this index has tended to show a high correlation with near-term market peaks.

I calculated 1 and 2 month market returns from the initial reading of 55 – an arbitrary, but high historical data point in the series. Going back 5 years the total returns on a one and two month basis are as follows:

1 month: – 3.98%

2 months: -4.28%

The above data points are heavily skewed by the market crash of 2008, however, the risk/reward proves to be little improved when removing the crash data. Markets still tend to trade lower to sideways:

1 month: -1.8%

2 months: 0.28%

Given the very high levels of bullishness and analyst expectations of economic data, we could finally be due for an equity market correction. That’s assuming that the Bernanke Put isn’t so firmly entrenched that it overrides any and all historically reliable data….

Source: Bloomberg

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.