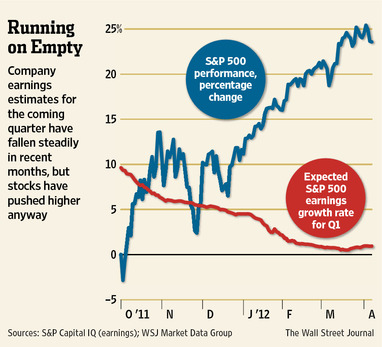

The WSJ had a good piece today on the collapsing expectations for corporate earnings. They report:

“Analysts have been lowering expectations for both first-quarter and full-year earnings. They now expect earnings to show average growth of 0.95% over a year earlier in the first quarter.

That would be the lowest rate of year-to-year growth since the end of the financial crisis, and down from expectations of 4.5% in early January, according to S&P Capital IQ. As recently as late September, analysts were looking for 10% growth.

By comparison, S&P 500 earnings rose 8.4% in the fourth quarter and 18% in the third quarter.”

So the good news is that the bar is set low for the upcoming earnings season. The bad news is that we’re already beginning to see signs of deterioration in the longer-term corporate profits picture. And that could be a potentially very worrisome change in trend (with downside risk I might add as budget deficits have been the primary driver of profits in recent years).

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.