This was a great piece in BBC last week on the “wisdom of crowds”. It reminded me of this recent study finding empirical evidence of herding on trading floors.

The article cites James Surowiecki’s book The Wisdom of Crowds and the point he makes about how crowds become increasingly fallible when they begin to incorporate the decisions of others into their own conclusions.

Of course, this idea meshes perfectly with financial markets. And it becomes increasingly prevalent in a complex system where the reliance on the decisions of others is increasingly likely. That is, a system like a financial market is so complex that we are increasingly likely to herd because we’re increasingly likely to incorporate the decisions of others into our own decisions. After all, even the “experts” appear clueless half the time so we’re more comfortable just moving along with the crowd as opposed to thinking that we’re better off fighting the trend.

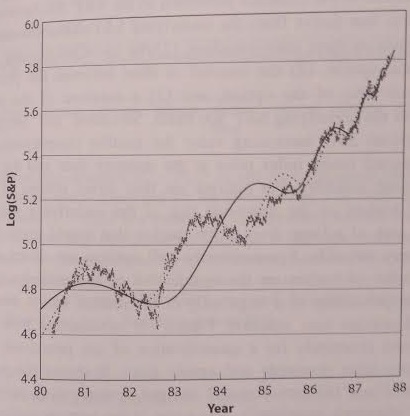

When you mesh this with our comfort moving in herds (as naturally social animals) you get a tendency towards disequilibrium in financial markets. And all of that reminds me of Didier Sornette’s log periodic bubble theory described in Why Stock Market’s Crash. Basically, as the crowd becomes more comfortable the market is actually becoming less stable. Which reminds me of Hyman Minsky’s Financial Instability Hypothesis which famously states that stability creates instability (lots of things are reminding me of other things here as you can see).

(Didier Sornette’s log periodicity)

I don’t know how useful any of this is to actually analyzing the stock market at any particular time, but it certainly helps one in developing an understanding of the behavior of financial markets in general.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.