One thing the financial crisis exposed was just how deeply backwards a lot of economic theory was in terms of understanding money. Most economic schools build their model of the world around outside money or money created by the government and the central bank. This includes bank reserves, cash and coins. And they tell us that credit and inside money (bank deposits primarily) are secondary because these are just “multiplied” or “leveraged” versions of outside money that are convertible into outside money.

Of course, I’ve argued that this is wrong and that we have a truly endogenous system in which we can all create money and banks hold a special importance because of their centrality to the payment system we all use. The “moneyness” of the item they create is unique in ways that outside money is not in regard to playing a crucial role in everyday economic activity. In other words, when understanding the monetary system it is best to start from the inside out, not from the outside in. In addition, we’ve discovered that the money multiplier is a myth, that banks don’t lend reserves, QE doesn’t create high inflation and the impact of increasing quantities of outside money is pretty muted.

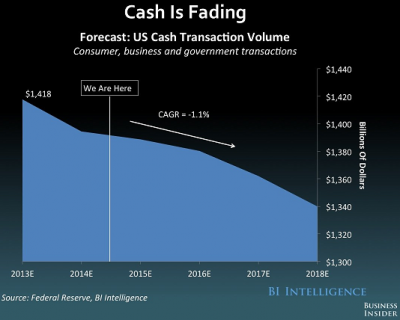

I’ve previously touched on the declining usage of cash in our society, but I was further reminded of this fact while reading this Business Insider report on the future of payments. They note the slow death of cash in processing payments:

As technology advances the banks are actually taking an even stronger hold over the system. They are making outside money increasingly less important. And they are exposing the reality that our monetary system is not constructed around outside money, but indeed revolves around the stability and strength of our banking system. Some might find that alarming, but that’s how the system has always been designed. The corporations rule the day and the government bends over backwards to service their needs. The construction of our payment system is no different really.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.