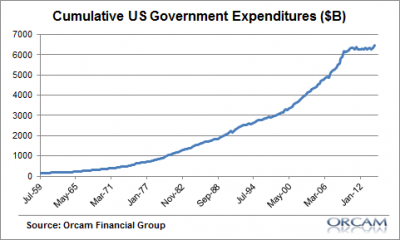

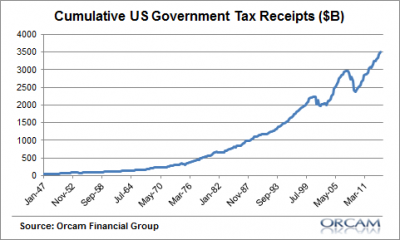

Yesterday’s CBO report on the deficit is being hailed as a demonstration in budget cutting by some people. Which is weird because total government expenditures are actually UP on a 1 year, 5 year and 10 year basis (not to mention the fact that a “deficit means”, you’re, um, still in a deficit even if it’s a smaller relative deficit). Yeah, cumulative government spending has been a little flattish over the last few years (though still up marginally), but the real reason the deficit is falling is because tax receipts are booming.

As you can see in the second chart tax receipts have surged by 7.7% year over year and are up 48% over the last 5 years. And while some of this is due to tax increases the vast majority is due to a healing private sector.

So yes, the deficit is shrinking. But as I’ve noted in the past, it’s important to know where this shrinkage is coming from or else you might be inclined to think that is is some form of real “austerity” and a sign of bad things to come. If it were real austerity we’d be seeing a sharp decline in cumulative government expenditures. Instead, this is actually a case of a healthier private sector which is just passing on more income to the government. If this were a case of austerity at a time when the private sector were doing much worse then the economy would be much weaker than it is as we see in many of the peripheral European countries. But that’s not what’s going on in the USA. In fact, the one place where we did see some austerity, state and local expenditures, have now completely reversed and the rate of expenditures at the state and local levels is now UP 3.1% as of Q2.

Hey, it just goes to show that while the deficit is falling, it’s likely that things would have been much worse if we’d actually implemented austerity in the USA. Luckily, we didn’t and the government filled in as the “spender of last resort” when much of the private sector was de-leveraging….And this explains why we’re doing so much better than Europe.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.