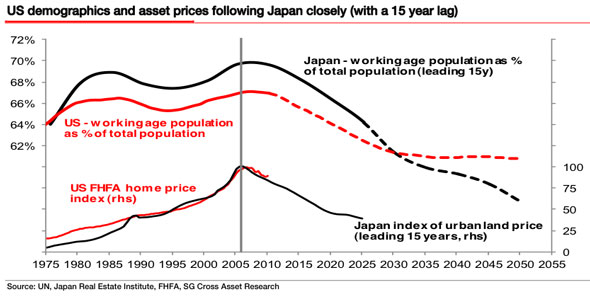

As previously discussed, the demographic headwinds in the developed world are challenging to say the least. The emerging world has far favorable demographic trends on the whole. The headwind in the USA might be more challenging than most presume. In a recent research note Albert Edwards of Societe Generale highlighted the similarity between Japan’s working class population and that of the USA (via Business Insider):

“The front page chart shows how asset prices in the US topped out 15 years after Japan (i.e. 2007 v 1992), entirely in line with the topping out of the working population as a share of the total. Now I haven’t really cracked this one but chatting this through with a number of people, I would suggest that although GDP growth may be more closely related to the absolute growth of the working population, asset price inflation may be more closely related to the proportion of workers in the general population.

If that is the case, as the former baby-boomers start to retire this burgeoning cohort will tend to liquidate assets.”

Are we more Japanese than we want to admit?

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.