I’ve been a macroeconomic bull for a long time now, but I have never had an affinity for the way Quantitative Easing was implemented during this recovery (QE1 was fine, but the subsequent programs struck me as unnecessary or improperly implemented).

I always thought QE was a policy that put the “cart before the horse”. What I mean by that is that the concept of “portfolio rebalancing” (which is one of QE’s main effects) is designed to reduce the supply of an asset and essentially force investors into a different type of higher risk asset. This is great in an environment where the fundamentals are improving (and they have been to a large degree), but can potentially create a disconnect in an environment where the fundamentals are not improving. I’ve compared it to a company that buys back stock in the face of a deteriorating business outlook. It doesn’t matter how much stock they buy back, the price is likely to fall if the underlying fundamentals deteriorate.

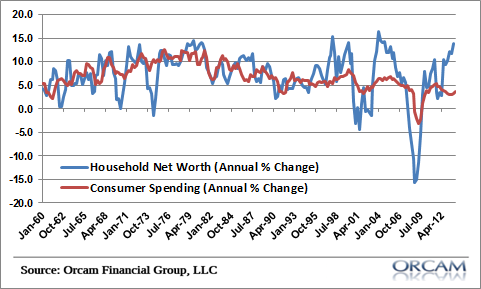

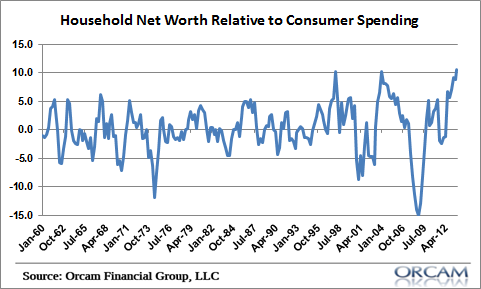

Anyhow, there has been a long running debate about the impact of the “wealth effect” and whether higher stock prices and real estate prices lead to sustained economic recovery and consumer spending. And it looks like we’re far enough into this experiment where we can come to a pretty solid conclusion. The following chart is household net worth relative to consumer spending.

And what we see here is a clear connection between changes in household net worth and consumer spending over time. But that all changed in the late 90’s when the stock market started to boom. The disconnect again grew during the housing bubble. So this makes me skeptical of the idea that large gains in housing and stocks lead to sustained consumer spending gains.

The current spread between household net worth and consumer spending, at 10.5 as of Q1, is the highest it has ever been. So, despite the boom in both housing and stocks there has been a growing disconnect between the size of the consumer’s balance sheet and the amount of spending. That doesn’t bode well for the idea of the wealth effect and it would seem to be much more consistent with the idea that this sort of “asset reflation” creates unsustainable bubbles and little in terms of sustained gains.

Related:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.