This is an important addendum to the latest piece on the problem of debt at the US household level. Several readers were quick to point out that the last piece (seen here) did not elaborate on the unevenness of the wealth disparity and the debt disparity amongst American households. The following paper from the Levy Institute’s Edward Wolff does a nice job of summarizing how the gap has grown over time and how the problem of debt is largely a middle class issue:

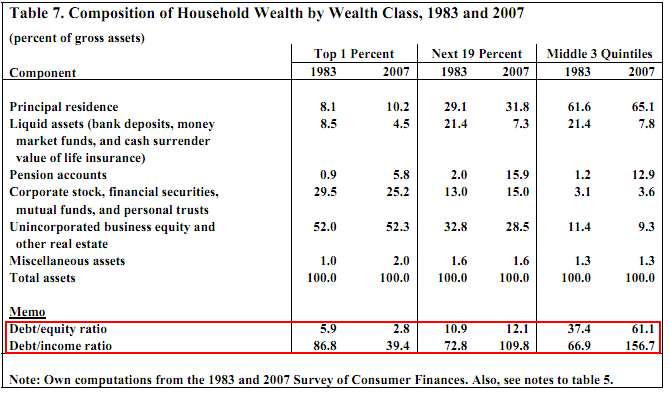

“I find here that the early and mid-aughts (2001 to 2007) witnessed both exploding debt and a consequent “middle-class squeeze.” Median wealth grew briskly in the late 1990s. It grew even faster in the aughts, while the inequality of net worth was up slightly. Indebtedness, which fell substantially during the late 1990s, skyrocketed in the early and mid-aughts; among the middle class, the debt-to-income ratio reached its highest level in 24 years. The concentration of investment-type assets generally remained as high in 2007 as during the previous two decades.”

As you can see, the author found that the problem of debt is increasingly concentrated on the middle class where debt/income ratios surged from 66.9% in 1983 to 156.7% in 2007! That compares to a decline for the top 1% of 86.8% in 1983 to 39.4% in 2007.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.