Congresswoman Marjorie Taylor Greene got a lot of attention over the weekend when she stated that the USA needs a “national divorce”:

I try to remain as objective as possible when I am writing here so I am going to apologize in advance if this post sounds political, but secession is a pretty political topic so let’s dig into the economics of the matter because I don’t think MTG has thought this one through.

First, I should start by making it clear that MTG’s comments are highly extremist and even more unlikely to come to fruition. While it’s a cute sound bite that gets a lot of media attention the economics of a divorce are disastrous. Let me explain.

The old joke is that divorce is expensive because it’s worth it. But the problem with this thinking is that the divorce would be disproportionately expensive…for Republican states.

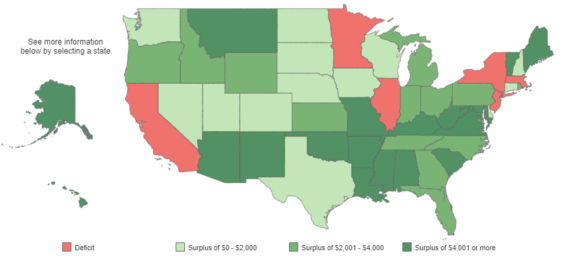

The basic economics of the intranational trade balances in the USA is that the wealthiest states tend to be blue states. This chart shows the domestic balance of payments transfers within the USA. The red states in this chart are net givers to the federal government and the greener states are net recipients from the federal government. 1

In short, the red colored states pay more into the federalist system than they get because they’re the ones that produce the most relative to their tax structure. California, Illinois, Minnesota, New York, New Jersey and Massachusetts are the only states that send more money to Washington than they get.

This is interesting in the context of MTG’s thinking because all of these wealthy states would remain unified in the former USA if there was to be a divorce. The states at the bottom, in order, are New Mexico, Mississippi, West Virginia, Alabama and Kentucky. So the strongest and wealthiest states would all remain in the existing Union and the poorest states would all leave.

The analogy I’ve always found useful here is the European Monetary Union. A state like Mississippi is the Greece of the USA. New York is the Germany. Greece is substantially better off within the EMU because they effectively inherit a lot of benefits from Germany and other more productive countries. They get a much more stable currency, lower interest rates, transfer payments, better terms of trade, etc. If they leave the Euro they will bring back a notoriously hyperinflated currency which will expose them to far more economic turmoil compared to their current situation. This is also bad for Germany and Greece’s neighbors because it creates more turmoil than they would otherwise have. This same thing would happen within the USA if many of the poorer states were to leave.

Of course, the rich countries also benefit. While they pay more into the system they also benefit from having relatively more stable neighbors. If Mississippi were to secede and create its own currency they would likely experience elevated interest rates, a very weak currency and bouts of high inflation. All of this would impact demand for goods in neighboring states. Said differently, the thing that makes the USA an especially unique economic powerhouse is that it’s a group of united economic regions with different strengths that are all leveraged together to create a union that is better on average than it would be if it was 50 separate countries.

And none of this even gets into the actual dynamics of the divorce. For instance, if the Republican states all leave the union then what happens to the payment system? What happens to the currency? They would have to leave the Dollar system and I presume they would each create their own currency because each state would want to control its own currency terms instead of having some centralized monetary authority like the Federal Reserve operating the entire thing. So you’d end up with 30+ new currencies and a highly disjointed payment system. Some of those currencies would be relatively strong. Texas, for instance, would probably be a very robust currency. It would be far less robust than the USD, but it would be very strong compared to its neighbors. But some of those currencies would have trouble competing with toilet paper.2

This would essentially unwind the entire payment system that grew interconnected specifically because the neighboring states needed a more cohesive payment system. Unwinding this wouldn’t just be messy. It would create all sorts of unnecessary turmoil and trade issues that would result in even more red tape than we already have across the nation.

But this is where this thought experiment would get really interesting because states like Mississippi would create their own currency, their own Central Bank and it would likely be the weakest currency in the entire continent. I don’t mean to pick on MS, but Mississippi is vastly better off within the Union because of this fact. Their net fiscal transfers from the federal government help them maintain affordable municipal bonds and fund public purpose that they might not otherwise be able to afford. The alternative would be much higher interest rates, poor terms of trade and in all likelihood bouts with high inflation every so often.

Again, I don’t mean to sound like I am demeaning Conservative states. I lived most of my life in Conservative states and I agree with many of the gripes that we’re all voicing about the size of the federal government at present. But I am also trying to look at this from an objective stance and this, my friends, is an egg that has long since been scrambled.

In short, the USA works well in large part because of the way it takes from its richest states and redistributes that wealth to its poorest states. This allows the poorer states to be wealthier than they otherwise would which contributes to aggregate demand and helps stabilize the entire economic region far more than if it were 50 independent countries. We don’t have to worry about our poorest states having municipal bond panics every few decades specifically because we’re united in ensuring that doesn’t happen. This is a good thing and we all benefit from this increased stability through the economic union.

I am not a marriage counselor, but this is a divorce that would be exorbitantly expensive for all of us. So I would recommend marriage counseling instead of rash decisions that would actually make us all worse off, though some far more than others.

1- NY’s Balance of Payments with the Federal Government

2 – This isn’t the best analogy considering that the demand for toilet paper is very high. Especially so in my house where we are potty training a 2 year old who thinks that she needs to wipe with an entire roll of toilet paper after peeing.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.