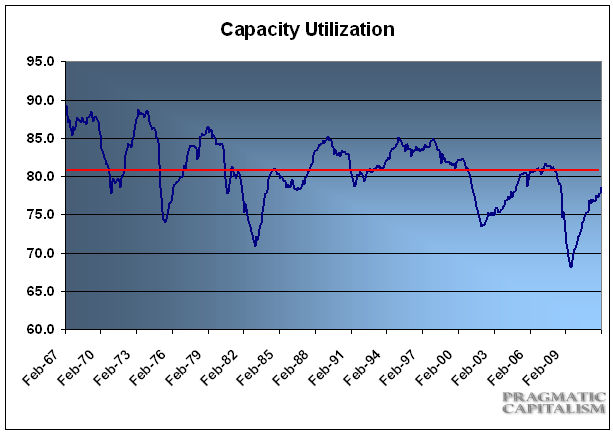

This morning’s industrial production figures were a bit mixed, but continue to show one clear conclusion – the US economy is operating well below potential capacity. The 45 year average in capacity utilization is 81. At 78.5, the US economy is just a few percentage points off of past recessionary levels and in a few cases below it! No wonder this still feels like a recession….The trend is certainly moving in the right direction, but the message is clear – we could be doing a lot better.

Econoday has some details on this morning’s report:

“Industrial production in January was unexpectedly soft but due to weakness in mining and utilities. The manufacturing component was robust. Overall industrial production was unchanged in January after a 1.0 percent jump the month before (originally up 0.4 percent). The January figure was well below the consensus forecast for a 0.7 percent gain. By major components, manufacturing jumped 0.7 percent, following a 1.5 percent comeback in December. Analysts projected a 1.0 percent spike for the manufacturing component in the latest month. In January, utilities dropped 2.5 percent while mining output declined 1.8 percent.

Within manufacturing, durable goods advanced 1.8 percent in January. The output of motor vehicles and parts surged 6.8 percent following an upwardly revised increase of 3.8 percent in December. In January, gains of more than 1.0 percent were recorded for fabricated metal products; machinery; computer and electronic products; electrical equipment, appliances, and components; furniture and related products; and miscellaneous manufacturing.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.