Late last year I discussed the likely decoupling of the US and European economies in 2012. I said the primary cause of this divergence was vastly differing economic approaches. Europe has implemented harsh austerity while the USA has implemented a persistent stimulative policy approach led by high government budget deficits. Since both regions are in a balance sheet recession in which the private sector is unable to sustain growth on its own, it’s imperative that the government step in to keep the patient from dying.

Unfortunately, the patient is nearly dead in many Euro nations where unemployment is 25%+ and growth has stagnated for years. The result of these diverging policy approaches has been the continued decoupling of the US and European economies. In a recent note Moody’s put this into visual form:

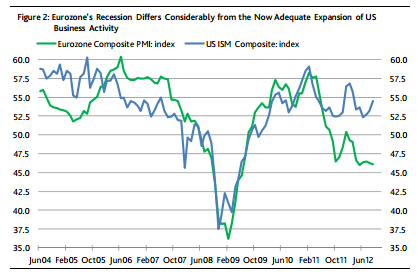

In addition to the slower growth of expenditures in many of the world’s once dynamic emerging market economies, a contraction of eurozone business activity weighs heavily on the global economy. Unlike the rise by the ISM’s composite index of US activity from August’s 53.2 to September’s 54.5, the eurozone’s composite PMI dipped from an already contractive 46.3 to 46.1. In terms of these diffusion indices, the US outperformed the eurozone by a record amount in September. (Figure 2.)

USA vs Euro Decoupling – Source: Moodys

Much of this was avoidable. But a vast misunderstanding of our disease and the monetary system has led to deeply misguided policy. Unfortunately, there are few signs that policymakers have learned their lesson yet….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.