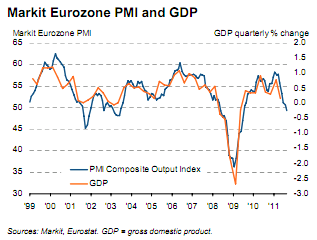

The Eurozone economy is officially contracting according to the latest PMI report from Markit. The contraction is the first in 2 years and showed some worrying deterioration. Markit elaborates on the data:

“At 49.1, down from 50.7 in August, the final Eurozone PMI Composite Output Index for September signalled the first drop in private sector activity since July 2009. The final reading was broadly unchanged on the earlier flash estimate of 49.2. The average reading for the third quarter as a whole was just 50.3 – signalling a stagnation of activity – down from 55.6 in Q2 and 57.6 in Q1.”

“Manufacturing production fell for the second month running, albeit at only a very modest rate. Meanwhile, services activity fell to a greater extentthan signalled by the preliminary estimate, contracting at the fastest rate since July 2009.

By country, activity at the composite level fell in both Spain and Italy for the fourth successive month, dropping at the fastest rates since July 2009 and August 2009 respectively. However, weakness was not confined to these nations. Activity rose only very marginally in both France and Germany, signalling that these recoveries, which both commenced in August 2009, have almost ground to a halt.

Chris Williamson, Markit’s Chief Economist, says the data is even worse than expected:

“The final PMI for September is even more gloomy than the earlier flash reading, providing confirmation that the Eurozone recovery has ground to a halt. A mild output contraction in September sits in stark contrast to the buoyant pace of expansion seen at the start of the year, suggesting that the economy will have stagnated in the third quarter as a whole. Even more disappointing is the steep drop in new business, which suggests that GDP will contract in the fourth quarter unless business and consumer confidence rallies in coming weeks.

Downturns have gathered worrying momentum in both Spain and Italy, while falling new orders in Germany and France threaten to drive these core countries from near-stagnation in September into contraction in October.”

So it’s pretty clear now that a fix to the EMU’s currency problems are just part of the picture. No matter what is done in the coming weeks or months will not likely fix the fact that we have a recession building in Europe….

Source: Markit

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.