I liked this datapoint from Lance Roberts of STA Wealth:

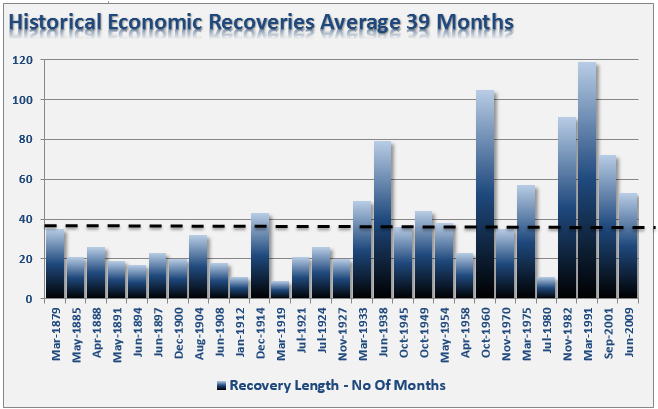

“Ultimately, all economic recoveries will eventually contract. The chart below shows every post recession economic recovery from 1879 to present.”

“The statistics are quite interesting:

- Number of economic recoveries = 29

- Average number of months per recovery = 39

- Current economic recovery = 53 months

- Number of economic recoveries that lasted longer than current = 6

- Percentage of economic recoveries lasting 53 months or longer = 24.14%

Think about this for a moment. We are currently experiencing the 7th longest economic recovery in history with most analysts and economists giving no consideration for a recession in the near future.”

That is interesting. But it’s also interesting to note that the expansion phase of the business cycle appears to be getting longer. You’ll notice that 3 of those 6 long recoveries occurred since 1982. Are these anomalies or are they signs of a changing economic landscape? I think they’re probably signs of a changing economic landscape and that means that a lot of the data that exists before the post-war era probably doesn’t apply. There are a number of reasons why this might be occurring:

- We live in an era of central banking where the support system designed around banking systems is infinitely more evolved and secure than it was 100 years ago. Central banks are far from perfect and certainly do things that result in exacerbating problems at times, but I also think that a system with central banking definitely helps secure what would otherwise be a rogue banking system run by profit hungry bankers.

- We live in an era with automatic stabilizers. In other words, we live in an era where policy now expands and contracts around the business cycle. For instance, tax receipts expand and contract as the cycle expands and contracts and that helps support the economy both in downturns and in upturns.

- The global economy is evolving, diversifying and becoming much more efficient. Corporations and economies no longer rely on undiversified income streams. Instead, we live in a world with an increasingly diverse income stream that has many different income sources. This helps create a more stable and steady overall global economy.

You all can probably think of other (perhaps better) reasons for this phenomenon (or maybe you don’t buy it at all), but I think it’s interesting to think about. That said, it doesn’t take away from Lance’s point – even if we use only post-war era data this recovery is still starting to get a little long in the tooth….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.