Well, we’ve been here before. In 2006 house prices were booming, stock prices were surging and the Fed was raising rates aggressively trying to get ahead of what looked like an overheating economy. But as the Fed raised short-term rates the end of the curve refused to budge. It was Alan Greenspan’s famous “conundrum”.

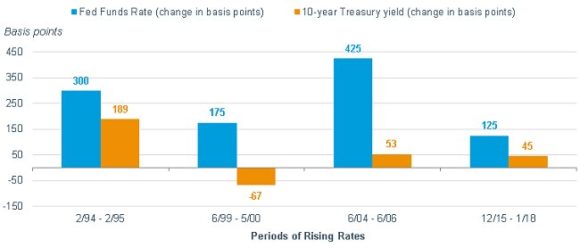

None of this is that unusual though. When the Fed raises rates they are typically signalling that they want the economy to slow. So short rates rise and long rates barely budge. Investors on the long end of the curve are preparing for what the Fed is trying to do – slow the economy.

In the last 4 rising rate environments the long end of the curve barely budged (chart via Schwab):

The Fed is in a real pickle here. It’s a whole new paradigm. After all, growth is still fairly low at just 2-3% per year and overnight rates are just 1.7%. Small moves in interest rates have a much bigger potential impact on the economy than they did in the old paradigms where growth was higher and the Fed had more flexibility.

But while growth is low, the asset markets are booming. The Fed certainly doesn’t want to be blamed for another housing boom, but they also don’t want to be too far behind the curve on wage inflation in the case that the economy really is about to take off from here. Add in a huge tech boom and you’ve got all the worries of the Nasdaq bubble to add to that.

The long end of the curve and the stock market seem to be thinking about this correctly in my view. They see the risk that the Fed could invert the curve in the coming years and if that’s the case then the research all shows that a recession is the next thing to come. The Fed is trying to thread the needle here between managing the risk of inflation and driving the economy into another asset price driven recession.

This is a tough spot to be honest. If I am the Fed I defer on the side of caution here. Inflation is still very low by any historical standard and growth is relatively stagnant. On the other hand, keeping policy too accommodative risks accelerating the boom. So maybe the Fed is playing this correctly by scaring the asset markets a little and letting them simmer down a bit. But it’s not going to be easy trying to thread that needle.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.