There is still a lot of chatter about the potential for a September rate hike by the Fed. I have to be honest – I think this is nuts at this point. Here are some general thoughts:

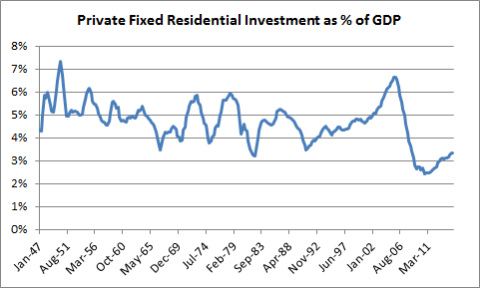

- We are still muddling along following the financial crisis. Yes, the crisis is in the rear view mirror, but the effects still linger. Housing, for instance, is still historically weak despite some of the progress we’ve seen in recent data. Here’s private fixed residential investment as a percentage of GDP. Does this look like levels that warrant concern? Or does it look like nearly the opposite of the 2003 environment when this data was moonshooting?

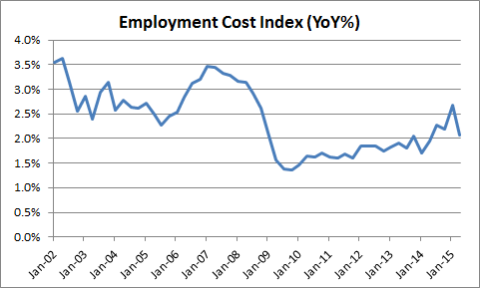

- Wage data still doesn’t show any signs of inflation. There was a brief glimmer of hope earlier this year that the Employment Cost Index and other wage data might show some upward pressure. The latest ECI report was a total dud at just 2%. These are not levels that warrant major concern about rising wages.

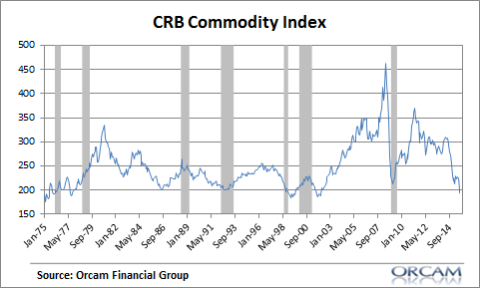

- Commodity prices are in a nearly unprecedented collapse. The CRB Commodity Index is at the same level it was in the 70’s. Does this look like an inflationary environment that warrants higher rates?

I’m not sure what the big rush is. The recent turmoil in foreign markets is a game changer that gives the Fed some space to be patient. While the USA is doing better than many other global economies we shouldn’t kid ourselves about the fragility of this environment. And raising rates would send the exact wrong message to global markets and other Central Banks – a message that could lead them to be much more proactive in the FX “race to the bottom” that could actually hurt the US economy more than anything. The potential upside of a rate hike is fairly limited. So what’s the rush?

NB – One theory that has been gaining traction is the NeoFisherian view that sustained low rates are actually deflationary. But we have to consider the changes in the global economic environment in the last 6 months. FX markets will alter their pricing based, in large part, on relative Central Bank policy. If the Fed implies that the US economy is much stronger than it really is and sets policy that is dramatically different from the rest of the world then we could continue to see this damaging dollar rally. Will a marginal increase in raising rates and interest income offset this broader dollar effect? I seriously doubt it. Hence, the need for patience here.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.