Rand Paul had another mental slip up the other day when he said the following:

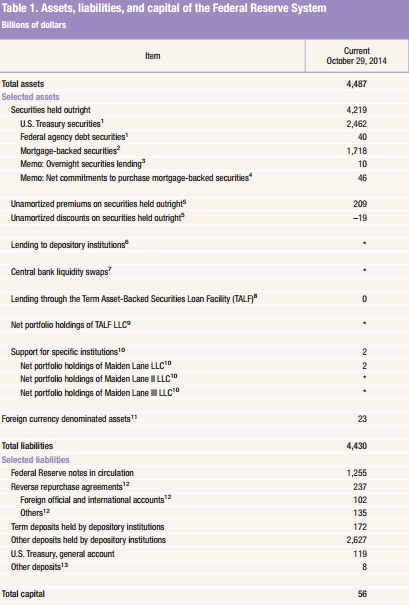

“They’d be bankrupt, they’d be insolvent,” he said. “[The Fed’s] liabilities are $4.5 trillion; their assets are $57 billion. Do the math.

“They are leveraged 80-1. They are leveraged three times greater than Lehman Brothers was when Lehman Brothers went bankrupt. Why do we give ‘em a pass? Because they’ve got a printing press, and they can print up some more money.”

Okay, a couple of things here. First of all, Paul means to refer to the Fed’s capital, not its assets. Total assets as of November were $4.487 trillion (see here). Total liabilities were $4.430 trillion. Total CAPITAL was $56 billion. So, Paul is getting basic accounting wrong to begin with. But it gets worse than that.

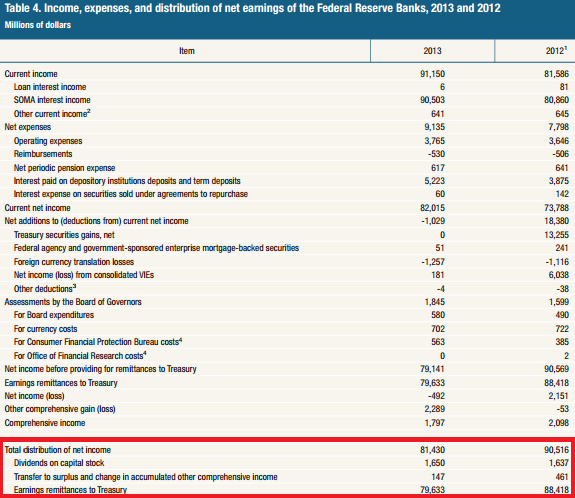

If you look at the Fed’s balance sheet from the 2013 annual report you can see that the Fed distributes most of its profits back to the US government every year. In 2013 they remitted $79.633 billion to the US government. In 2012 they remitted $88.418 billion to the US government. Over the course of the last 10 years they’ve remitted over $500 billion.

The Federal Reserve isn’t just a profitable entity. It is perhaps the most profitable entity on the face of the planet. Rand Paul’s comments on this matter are not only factually wrong, but extremely misleading. If you’re going to advocate the auditing of financial entities you should, at a minimum, get the basic accounting right. While perhaps well intentioned, it’s clear that Paul is on an ideological witch hunt driven by his own misunderstandings and populist thinking.

Related:

- Rand Paul’s Federal Reserve Goose Chase

- The US Government is not $16 trillion “in the hole”

- Why the US government isn’t going bankrupt

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.