Earlier this year I said the Fed was increasingly at risk of a policy mistake. My basic thinking on this was as follows:

- Excesses in the financial markets and economy were obvious in May of 2021 when I said that the Fed should be raising rates.

- Inflation kept rising at an uncomfortable rate which warranted some Fed offset, but they remained behind the curve well into late 2021.

- By the time the war in Ukraine was in motion the economy was already showing worrisome signs of slowing, but energy prices were surging.

- All of this put upward pressure on inflation that forced the Fed’s hand to play “catch up” with the risk of overtightening.

- They had to save face to maintain “credibility” and moved very aggressively, too aggressively, but now they’ve risked exacerbating the slowdown in the other direction.

First, you already have signs that inflation has peaked. Outside of a major shock in Russia or China, the underlying data is very likely to show moderating inflation in the coming year.

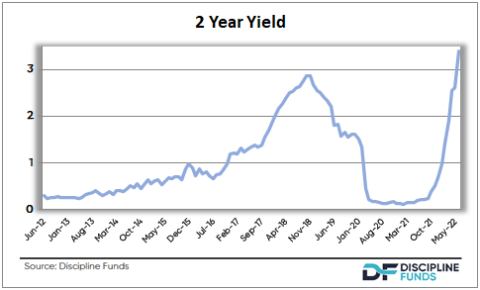

Second, you have the Fed raising rates very sharply. People sometimes look at the actual Fed Funds Rate to see how tight policy is, but Fed policy isn’t based on the actual FFR. It’s based on the future expected path of the FFR. So, for instance, if we look at the 2 year yield we can see that the future expected path of rates is actually closer to 3.5%. Or, for more direct economic impact we can look at something like the 30 year fixed mortgage which has surged from 2.5% to 6.3%. This is a shockingly fast tightening of policy.

FFR. So, for instance, if we look at the 2 year yield we can see that the future expected path of rates is actually closer to 3.5%. Or, for more direct economic impact we can look at something like the 30 year fixed mortgage which has surged from 2.5% to 6.3%. This is a shockingly fast tightening of policy.

Third, this sharp surge in rates has occurred when almost all markets are at record high prices. Equity markets and bond markets have adjusted, but the housing market is much, much slower to adjust and much more important. And adjust it must. The math here is not great. I wrote about the bearish case for real estate earlier this year. But that was when rates were at 5%. The math on mortgages at 6.3% is hideous. And when you combine it with a $40T loss in global financial markets it compounds. The median monthly mortgage payment jumped from $1,050 to $1,850 over the last 9 months according to Goldman Sachs. This combination of the price surge AND mortgage cost increases has pushed housing affordability even further out for millions of families.

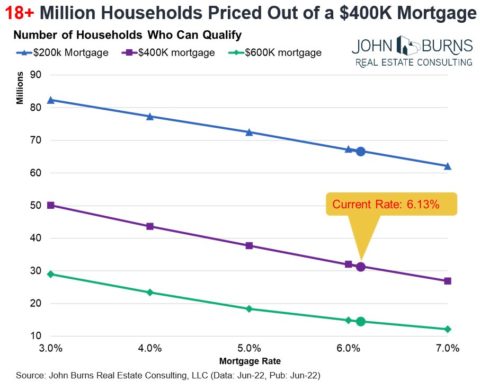

To put this in perspective consider this chart from John Burns Real Estate which shows the demand side impact of high mortgage rates. When we look at a $400K mortgage the change in rates from 2.5% to 6.3% reduces the qualifier pool from 50 million households to 30 million households. That’s a 40% decline in the pool of potential borrowers.

To put this in perspective consider this chart from John Burns Real Estate which shows the demand side impact of high mortgage rates. When we look at a $400K mortgage the change in rates from 2.5% to 6.3% reduces the qualifier pool from 50 million households to 30 million households. That’s a 40% decline in the pool of potential borrowers.

Although a slowing real estate market is the most worrisome aspect of this it’s not the only impact. The broader financial market impact is significant and stretches across the full spectrum of markets. For instance, high yield bond issuance has evaporated. Venture capital funding has evaporated. New business formation has evaporated. Auto loans are just starting to slow. The entire economy (and banking/credit system) was structured for low interest rates and now it’s being forced into an unprecedented adjustment to higher rates in record time. And that’s the thing that worries me most here. We are still very, very early in this slowdown. These credit market adjustments will takes quarters and perhaps even years to fully play out.

This morning’s retail sales data confirmed a lot of my thinking here and the Atlanta Fed adjusted their GDP Now model to 0% as a result of this. Remember, this is early stages here. The financial markets are pricing in a lot of this, but the Fed is way, way behind the curve here. They’re panicked over trailing 12 month CPI data and surging energy prices when all the forward looking financial market data is starting to scream slowdown and disinflation. I think they’ve made a huge policy mistake and have already overtightened which will not only result in a recession, but rising unemployment which is a direct breach of their mandate.

So, now we wait and see. A slowdown is increasingly likely. But does it turn into a recession? Does it turn into a deeper recession than expected? Does it spill over into credit markets and cause a debt deflation. I don’t know, but one thing I do know is that when the history books are written about the Fed rate management period of 2020-2023 they will question the validity of relying on discretionary interest rate policy in such a haphazard manner.

Real-time update – The Fed statement is out and they’re projecting higher unemployment, slowing GDP, more aggressive near-term rate hikes and….RATE CUTS in 2024. I used to joke that the Fed would raise rates to cause a recession that they can save us from with lower rates, but now they just outright tell us that’s their plan.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.