It’s no secret by now that the Fed believes the “wealth effect” via asset prices helps drive the economy. So, with rumors of QE3 growing louder by the day, we now just need a final excuse for the Fed to act. I think inflation is going to creep lower into the end of Q2 so that will give the Fed some flexibility here. I also still think the likely implementation of the program is the June meeting. But what would be the final impetus to ignite the response? SocGen says it will be a market sell-off (via Business Insider):

“QE3 has been delayed by the recent bout of good news from the US economy: SG is now in line with the consensus, expecting the launch in Q2 (24-25 April FOMC meeting).

As the $400bn Operation Twist program is still boosting demand for long-dated US Treasuries, we believe the Fed will be concentrating its expected $600bn QE3 on buying mortgage products to provide support to the underlying property market.

While policy loosening can but be good for all financial assets, the market impact should be less strong than during QE1 or QE2, as the surprise effect has disappeared.

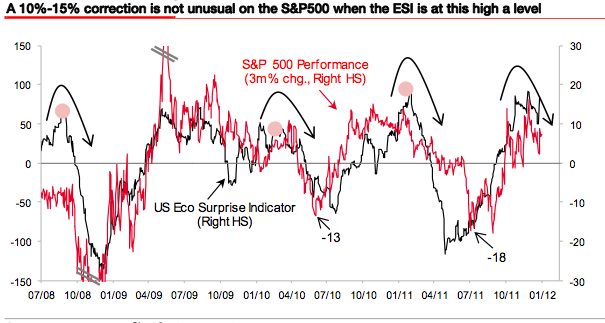

QE1 and QE2 were launched at a time when the US Economic Surprise Indicator (ESI) was

very low. This time, the ESI has moved back up to an all-time high, indicating that the consensus on the economy may have become too optimistic and thus possibly putting risk assets in danger in the near future.”

Makes sense to me….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.