“If you must play, decide upon three things at the start: the rules of the game, the stakes, and the quitting time.” -Chinese Proverb

As a society we have been conditioned to believe that there is a difference between gambling and investing. Of course, this partially true, however, the degree to which we “invest” and “gamble” is smaller than most are likely comfortable admitting. The majority of us have been conditioned to believe that buying a share of Bank of America is vastly different from placing a bet at a roulette table. A closer inspection of “investing” and “gambling” shows that the two are closer than the Wall Street sales machine would like you to believe.

60 Minutes aired an excellent piece this past Sunday about Billy Walters (video attached below). Walters is a Las Vegas gambler widely acknowledged as one of the greatest gamblers Vegas has ever seen. He’s so good that he has to bet anonymously through partners due to the fact that most casinos won’t take the other side of a bet from Walters. The few casinos that do bet with Walters do so mainly because they want to know what he’s thinking. But Walters isn’t truly a gambler. Walters is so good that he feels safer gambling than investing. And ironically, it isn’t the casinos in Vegas that have taken Walters for a ride over the years, but Wall Street. Walters claims that it is not Vegas where the thieves live, but rather the men in suits on Wall Street.

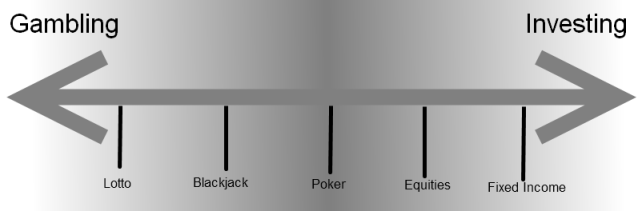

Before we can understand the difference between gambling and investing it’s best to define each. Gambling is placing capital at risk of loss with an uncertain outcome in a system in which the odds are generally unfavorable. Gambling has an inherently negative connotation because it is generally a term used to describe games in which the player is a guaranteed loser over the course of the game’s lifetime. Unlike investing in equities, a bet at a casino generally has unfavorable odds. The game is intentionally devised as such. Investing, on the other hand, is placing capital at risk of loss with an uncertain outcome in a system in which the odds are generally favorable. The primary difference between gambling and investing is the determinability of the outcome. The lottery for instance, is entirely unpredictable. Purchasing government bonds has a high level of predictability. The following diagram helps break down the gambling/investing spectrum:

So we can differentiate investing from gambling only to the extent that the outcome is predictable. There’s obviously a vast gray area involved in determining the future outcome of anything. As the great physicist Neils Bohr famously said:

“Prediction is very difficult, especially about the future.”

According to chaos theory, in the long-term, all outcomes in dynamical systems can ultimately be rendered unpredictable. In the short-term, however, these systems display levels of stability that make them somewhat deterministic. Some systems are more deterministic than others, but the outcome is always ultimately unpredictable when taken to an extreme. The lottery, for instance, is always unpredictable. There is nothing (or very little) the player can do to alter the outcome, improve their odds or increase the predictability of the game’s result. Buying government bonds, on the other hand, is generally considered a safe “investment” due to the high level of predictability involved in determining the outcome. But even in this instance there is still an element of gambling. The USA appears like a highly solvent entity (and I have argued as much ad infinitum), however, none of us can entirely discount the potential that something truly traumatic could happen to this very stable entity and render it unstable and ultimately insolvent. So while an “investment” in US government bonds is generally described as an “investment” the only thing that differentiates it from a “gamble” is the extent to which we can predict the outcome of the USA’s ability to remain solvent.

As I mentioned above, the primary difference between what most people consider gambling and investing is the level to which the outcome can be determined. For Bill Walters he is not gambling because he has essentially established that the outcome can be determined with a high degree of confidence. When Bill Walters bought Enron stock, however, he was unknowingly gambling. Most of the investors who bought bank stocks over the course of the last 25 years were ultimately gambling because the complexity of the banking system created a highly unpredictable environment. The degree to which most investors can determine the future value of a stock is lower than most of us would likely feel comfortable with. As I often say, we know less (in most cases MUCH less) than we think we know. Like Bill Walters, however, some players in the game of investing and gambling simply have better information, knowledge or an understanding of the system that provides them with the ability to better predict the outcome. For these participants the lines are skewed with regards to what they might consider a “gamble” or an “investment”. They have an edge that makes the future outcome more predictable.

For the majority of us mere mortals, who are of average intelligence and information, we cannot necessarily determine the probability of an outcome with a higher degree of confidence than the majority other participants in the game. This is ultimately why most fund managers and small investors lose to a simple correlated index fund after taxes and fees. The key to gambling or investing is increasing the degree to which the outcome can be determined. This is easier said than done, however, it does not leave the small investor helpless.

In addition to superior knowledge and information players can also increase the determinability of a system by controlling the system to some extent. Although you can’t establish the rules of a poker game you can manage the game to an extent that you control its outcome to some degree. Likewise, you can’t control the profitability of a corporation, however, you can control and manage your investment to an extent that you generate a more predictable outcome. In a poker game this might involve bluffing or managing your cards in a fashion that increases your odds of winning. A simple example in the investment world is writing covered calls on an equity position. By writing the calls on an existing position you have created a more predictable outcome. Of course, in doing so, you have reduced your potential reward, however, the pay-off is a more predictable outcome. Position sizing, money management, hedging, diversification, etc are all forms of managing a system in a way that makes its outcome more predictable. Like the investor with superior knowledge or information you are essentially creating an edge through the management of the system. This reduces the degree to which your actions can be described as gambling.

While most “investors” are comforted by the fact that they are purchasing American corporations in a regulated system, the truth is that most of the participants are gambling to a large degree. When you reject the Wall Street sales pitch that you are always “investing” when you buy stocks you can then begin to think about money management and risk management and only then is your entire perception of the system and approach altered. Your goal as an investor should not be to merely generate profit, but to do so in a manner in which you are managing risk and helping to generate an outcome that is predictable with a high degree of confidence.

On the back of two bubbles, a decade of flat returns and a market collapse, investors are now beginning to reconsider the idea that there is a substantial difference between investing and gambling. There is, in fact, a gray area between investing and gambling, however, that does not mean you have to be a Wall Street gambler when you purchase equities or other financial instruments. The degree to which you are a gambler is ultimately determined by your knowledge of the system and your approach in managing that system. Don’t fall prey to the Wall Street sales pitch that says the purchase of equities is nothing like gambling. The truth is, we’re all gambling more than we want to admit. But the difference between the winners and losers is that the winners recognize this fact and exploit it while the losers get taken for a ride.

Source: CBS News

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.