Last month I referred to this recovery as “the economic recovery that can’t get any respect”. And it’s true. If you look at a lot of the data things are actually pretty good. In fact, if you look at this recovery compared to past recoveries and adjust for how long and smooth this recovery is then it actually shapes up pretty well. But there’s no convincing all the pessimists who continue to see this as a glass half empty recovery. Unfortunately, this is the sort of thinking that has led many investors to miss the boat.

This glass empty/full idiom is a useful way of thinking about how the economy and the financial markets expand and contract. I like to think of the economy as growing inside of a new normal all the time. So, each “cycle” is its own unique environment. But it’s not nearly as “cyclical” as one might think. That is, the economy isn’t swinging from empty glass to full glass in some symmetrical fashion. Instead, it tends to swing from about 90% full to about 95% full. But this 5% swing has a huge impact on growth. And the economy tends to spend a lot more time moving off of the 90% range TOWARDS the 95% range than it does moving FROM the 95% range towards the 90% range. We know this to be empirically true because the economy spends roughly 75% of its time in expansions. Contractions are rather unusual.

But the problem is that those contractions tend to be scarring. The last one was particularly scarring. And when we see such an event playing out we often overreact and assume that a half full glass is going to get emptied out. Of course, this never happens because people get up in the morning, go to work, and as time goes on we get back to making innovative and amazing goods and services that project us even higher than we were before. And yes, we are higher than we’ve ever been before.

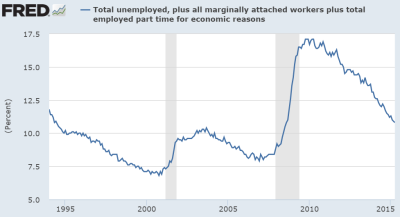

The interesting thing about this recovery is that the glass is still half full. Even though we’re at all-time highs in many indicators yesterday’s employment report showed that there is still a huge amount of slack in the economy. And this is where most of the analysis has been so wrong for so many years. You see, people tend to take a chart like the U6 unemployment report and say “look how bad this figure is in historical terms!”

And they’re right. But that elevated chart means there’s a workforce of people looking for work who want to earn an income and contribute to the economy. And as they come back into the workforce over the years incomes grow, revenues expand and the glass fills up. And that’s exactly what we’ve been seeing over the last 7 years. The glass is filling up. But the important point is that the time to be scared isn’t usually when the glass is 90% full and emptying. The time to be scared is when the glass is 95% full and capitalists feel like they need to start dumping some water out….We’re not there yet. But we’re on our way.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.