“A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty.” – Winston Churchill

We seem to live in an environment of perpetual fear. I see it almost every day in the financial markets and this seems to have filtered into the broader sense of well-being across the country. I suspect that this fear is largely overblown. As this story over at Econompic argued, it’s not that the world is becoming more dangerous, it’s that we just know more about those dangers so the world feels more dangerous. I think that’s a pretty accurate description of the world we live in today.

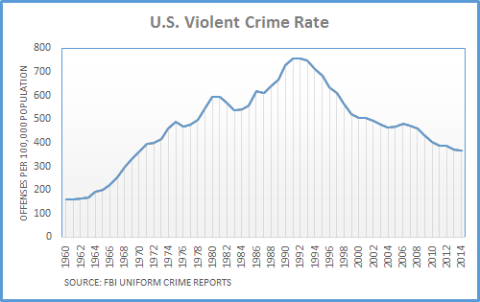

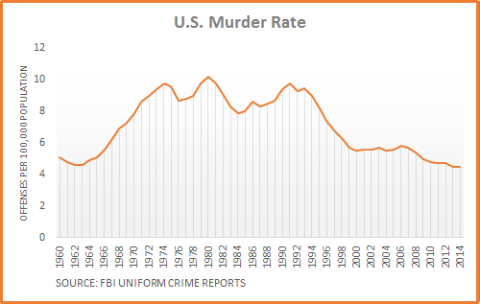

I spent a lot of time watching the Republican National Convention this past week and there was an awful lot of negativity. Some of it was overblown (like the fearmongering over crime when violent crime has actually fallen)¹ and some of it was accurate (like the fact that many Americans are struggling financially)². I tend to think the negativity is a bit overblown (for instance, American living standards are not in decline as I showed here), but I understand where a lot of it is coming from. There is, after all, a lot to be frustrated about including the signs of rising inequality, rising corporatocracy, lack of wage growth, etc. To a lot of people the Great Recession doesn’t feel like it ever ended. But maybe all of this negativity isn’t such a bad thing….

I love the Churchill quote at the beginning of this piece because the solution to any of our current problems isn’t fear. In fact, there might be a silver lining in all of this fear – it gets people motivated to act. And as Churchill also said, Americans will always do the right thing after exhausting all the alternatives. What looks like our messy political process might just be the process of exhausting all of our options in the process of finding the right one.

A perfect corollary to this is the stock market. The old saying is that the stock market climbs a wall of worry. A bull market is little more than the process of realizing that things are getting better. This is why, when there tends to be a lot of negativity, there tends to be better returns in the future. This is due to the fact that there are more good stones to overturn in the future as these bearish investors slowly realize things aren’t nearly as bad as they think. Similarly, one could argue that there are more bad stones to overturn in the process of realizing they’re not as bad as we thought.

The same process of improvement in living standards will occur as fear rises. As we become more aware of our real problems we dedicate more effort to turning over those bad stones. And we’ll polish them off and realize they’re not as bad as we thought. In this way, our negativity can be a fuel that drives the improvement of future living standards. And I have no doubt that my children and their children after them will live better lives than we do. In part because Americans are problem solvers. But we can’t let all this negative rhetoric turn into perpetual pessimism and hate-filled fearmongering. This doesn’t lead to problem solving. It leads to chaos and destruction. As Churchill said, there is opportunity in every difficulty. So let’s keep our heads up and keep solving problems.

All that said, it makes sense to leave you with a complete exhaustion of my repertoire of Winston Churchill quotes:

“I am an optimist. It does not seem too much use being anything else.”

¹ – Violent crime and murder rates are way down in the last 20 years. We live in an unusually peaceful time in the USA and I suspect this feeling that the country is less safe is mainly due to the media’s imbalanced coverage combined with the 24/7 news cycle in which we’re simply more aware of the crimes being committed.

² – See the Fed’s report on household finances which reports that forty-six percent of adults say they either could not cover an emergency expense costing $400, or would cover it by selling something or borrowing money and 31 percent, or approximately 76 million adults, are either “struggling to get by” or are “just getting by.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.