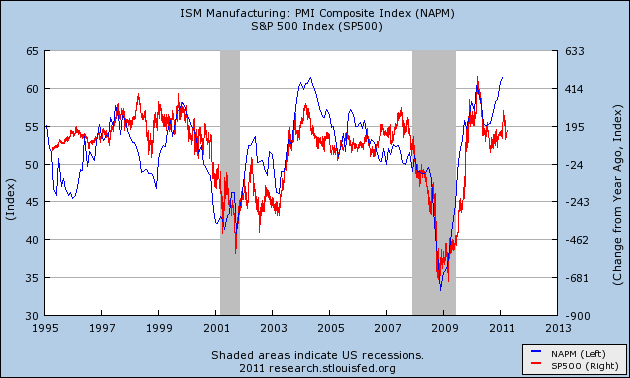

It might be time for investors to temper their expectations for future equity returns. That’s what the ISM Manufacturing data could be forecasting given its recent correlation with the S&P 500. According to Jeffrey Kleintop of LPL (via Bloomberg) the pace of change in the ISM’s diffusion index has a very close correlation with the year over year change in the S&P. I went into the Fed database to run the numbers and the correlation is indeed tight:

This doesn’t spell impending doom, but it does mean the red hot returns of the last few years are likely set to slow. With the diffusion index at its 20 year highs there is a very small chance that we don’t begin to see mean reversion in the coming quarters. Of course, this doesn’t mean we won’t continue to see year over year gains and economic expansion, but it does mean the pace of gains in the S&P will become more muted as expectations of robust economic growth decline.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.