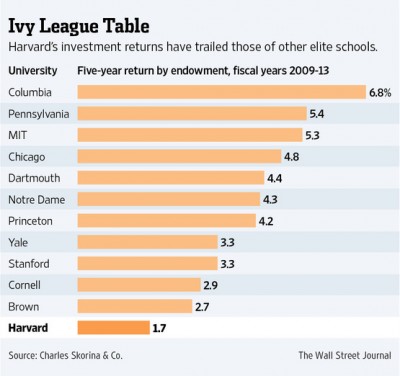

The Ivy league schools are well known for generating the best returns in the investment world in large part because they can attract the most talented managers. But a funny thing has happened over the course of the last five years – the best schools have underperformed just about every major index by a pretty healthy margin. This chart via the Wall Street Journal shows the five year annual returns by school:

This is pretty interesting given that a 60/40 stock/bond portfolio has generated a 6.3% return, the hedge fund HFRI has generated a 4.66% return, the iShares Bond Aggregate has generated a 5.1% return and the S&P 500 has generated a 7% return. I haven’t calculated the risk adjusted returns here for each school, but a cursory review of the returns leads me to believe that many of these funds could be suffering from diworsification (is that even a word?). What I mean is that these funds are diversifying across so many different asset types that they’ve actually diluted their potential returns as a result.

Over the last 20 years we’ve seen huge moves away from standard stock/bond models towards something that resembles a stock/bond/alternatives/hedge funds/private equity/natural resources allocation. Hedge funds and private equity firms obviously implement a broad set of strategies and natural resources are always a questionable allocation in my view. The CRB Index has generated a 1.5% annual return over the last five years. And while hedge funds and private equity funds can certainly generate beneficial returns we’re seeing more and more dollars compete for the same amount of alpha there. The result is what we’re seeing at funds like Harvard where, if you’re not in the right funds, you’re paying high fees for negative alpha.

This all makes me wonder if we aren’t seeing a case of overcomplicating portfolio construction here. Or worse, building it on some flawed foundations (such as the myth that natural resources are “investments”). I always say that portfolio construction is a process. But overcomplicating that process can result in return dilution if we make things more complicated than they need to be.

Sources:

1 – Investment Beliefs of Endowments

2 – Private Equity Returns, Myths and Reality

3 – Lessons Learned at Harvard, Barrons

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.