I hate to oversimplify things, but sometimes it’s easier to grasp an issue when we focus on its primary cause. In the case of the balance sheet recession, there is one primary cause – housing debt. According to the NY Fed 74% of all consumer debt is mortgage related. So, it’s no surprise that a housing bubble and a subsequent bust would lead to a balance sheet recession. And as housing has remained depressed the private sector has remained depressed. This also is not surprising given the tremendous headwinds that still confront the housing market in the USA. Moody’s recently elaborated on the situation:

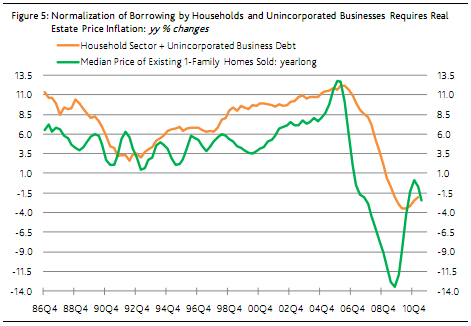

“Real estate price deflation trims private-sector borrowing. The first quarter’s 3.4% year to year drop in unincorporated business debt consisted of a 3.8% decline by mortgage debt and a 2.3% retreat by non-mortgage debt. Mortgage obligations comprise a comparatively large 73% of unincorporated business debt, wherein 13 percentage points of that share are home mortgages, 22 points are multi-family mortgages and 38 points are commercial mortgages. Mortgages supply an even greater 77% of household-sector debt. Thus, the price performance of real estate wields considerable influence over the paths taken by indebtedness of unincorporated businesses and households. Indeed, a normalization of the supply of credit to households and small businesses may be contingent on a convincing recovery by real estate prices. (Figure 5.)”

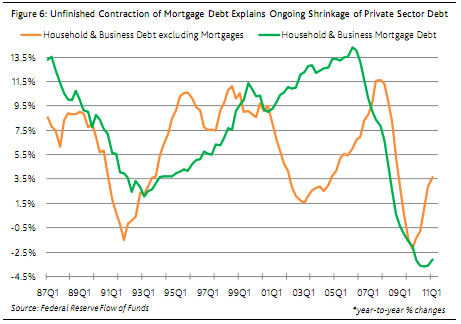

“In fact, the unfinished shrinkage of mortgage obligations fully explains the ongoing contraction by the broadest measure of household and business debt. The first quarter’s 0.2% year to year dip in private nonfinancial-sector debt was comprised by a 3.1% drop by mortgage obligations and a 3.7% increase by non-mortgage debt. (Figure 6.)”

So the balance sheet recession and housing markets are intricately interconnected. Finding the bottom of the balance sheet recession might be as easy as finding the bottom of the housing market. That’s easier said than done. Hopefully, when I have some time one of these days I’ll release my latest update on the outlook for housing. That should provide us with some insights into the potential end of the balance sheet recession and the beginning of the next leg up in an organic and sustainable recovery.

Source: Moodys

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.